Today we are going to study how trends transition to more or less flat markets and how to position ourselves for the best!

I am sure most of you are already familiar with indicators which supposedly indicate when a market is trending, and when you would be better off sleeping and out of the market.

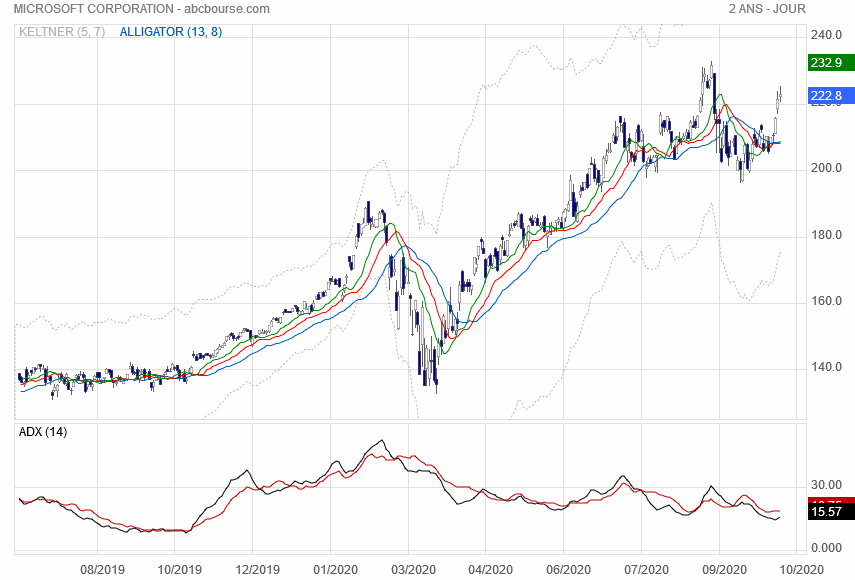

Moving averages are close to be one of best indicator for that purpose. See that graph of Microsoft with Alligator indicator. Note ADX indicator at the bottom does not indicate too much!

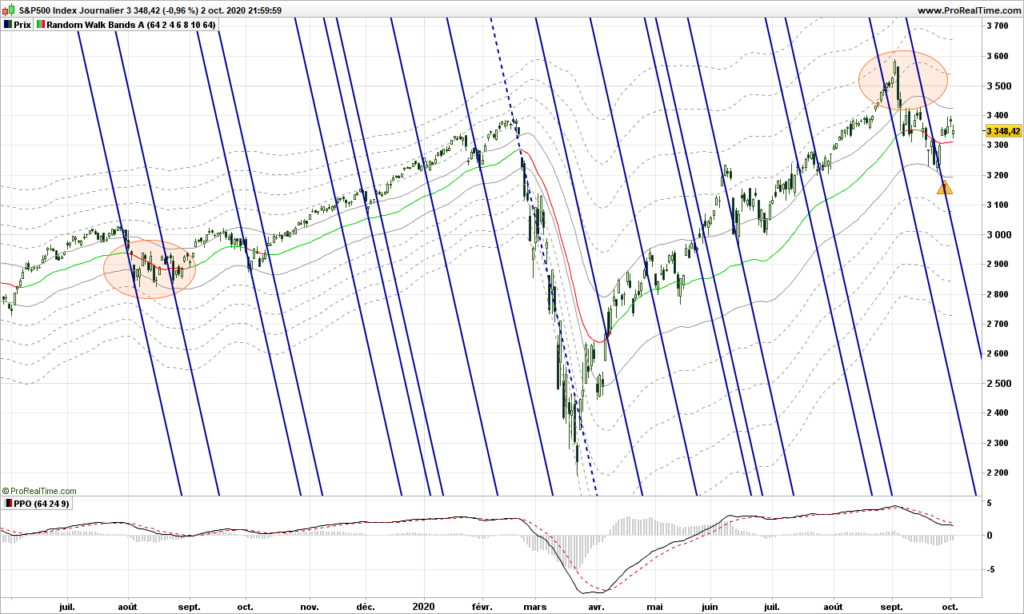

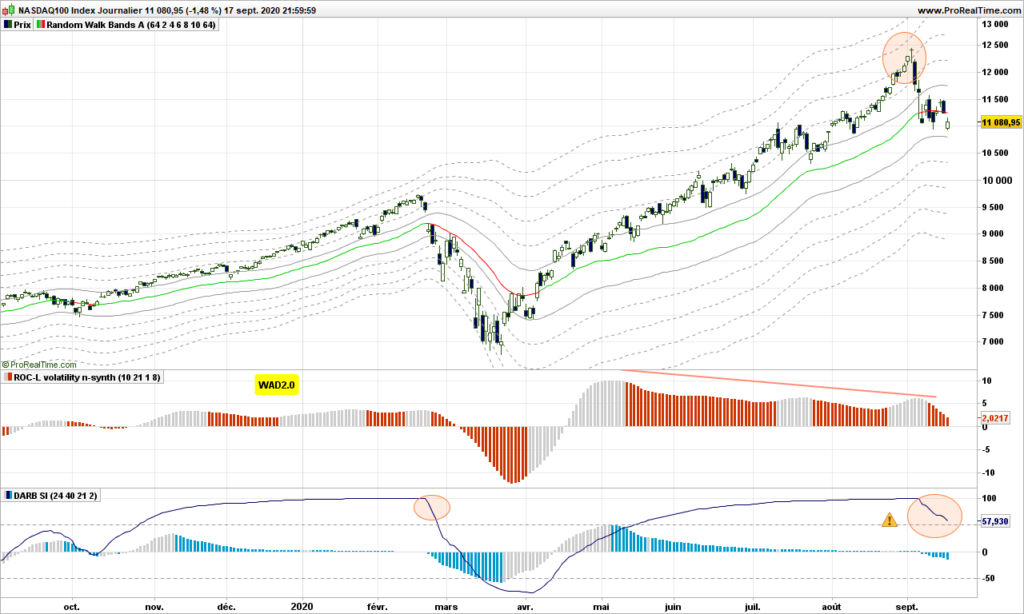

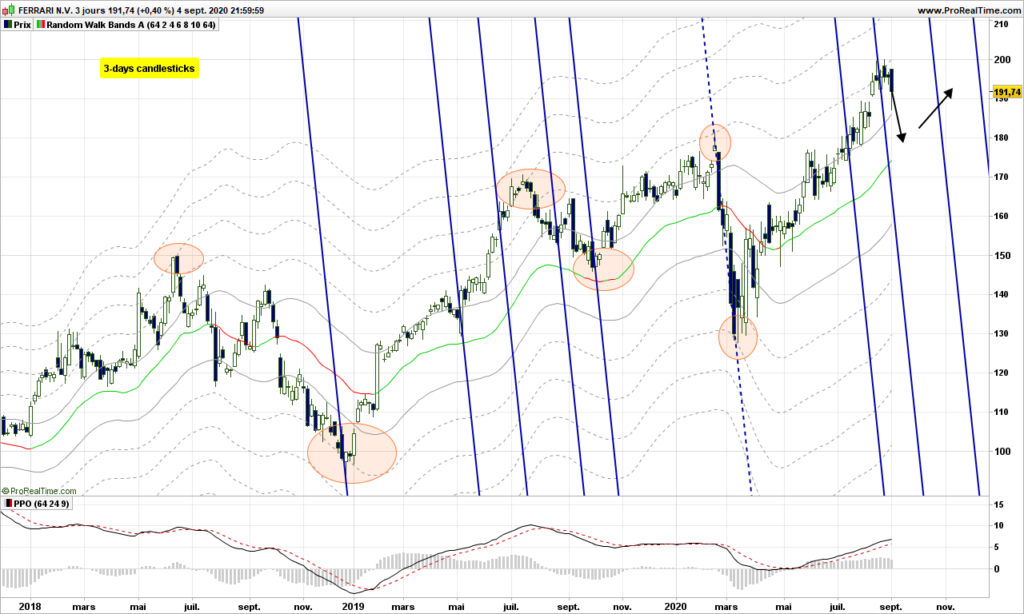

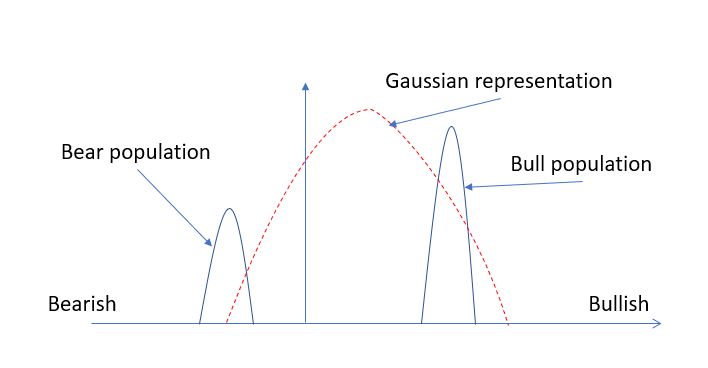

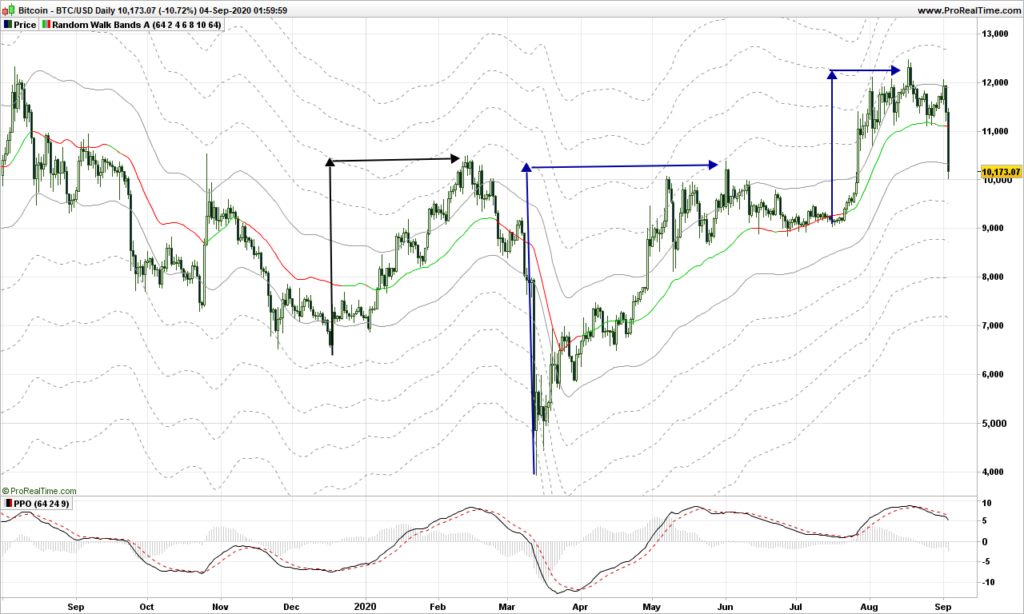

The truth is investors are either having the same opinion at the same time and there will be a trend or investors disagree and market ends up being choppy and overall very flat. So any time that you see what could be the end of a trend, switch to drunkard mode and start counting the steps! If you need background information, please refer to this blog post.

Sure enough you could wait for prices to cross Alligator lines and then that colors are in the right order, … then you may have lost 50% or more the big next move! You need think differently. Don’t worry, I will skip the action-reaction lines for today!

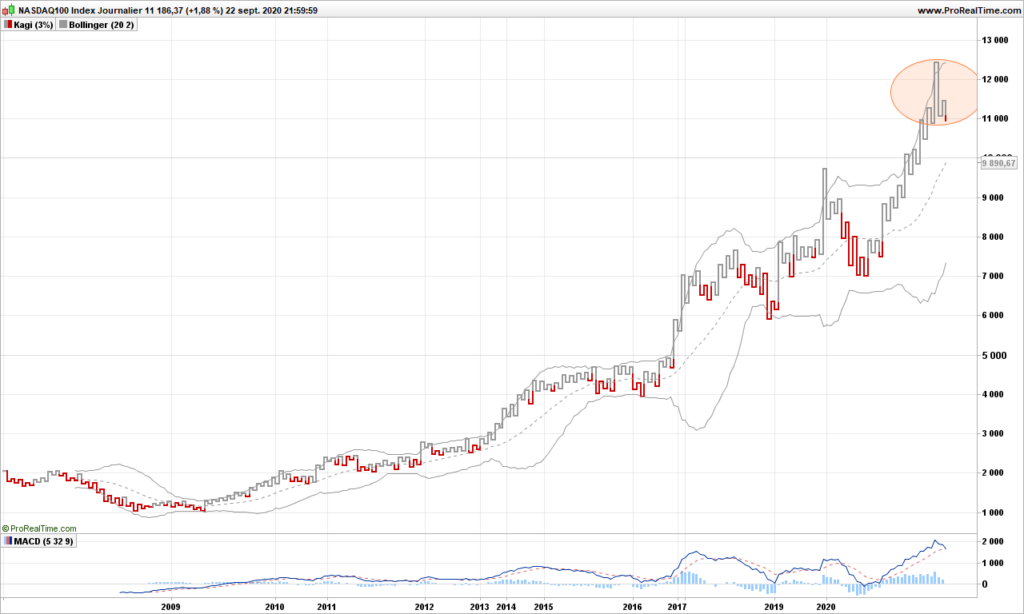

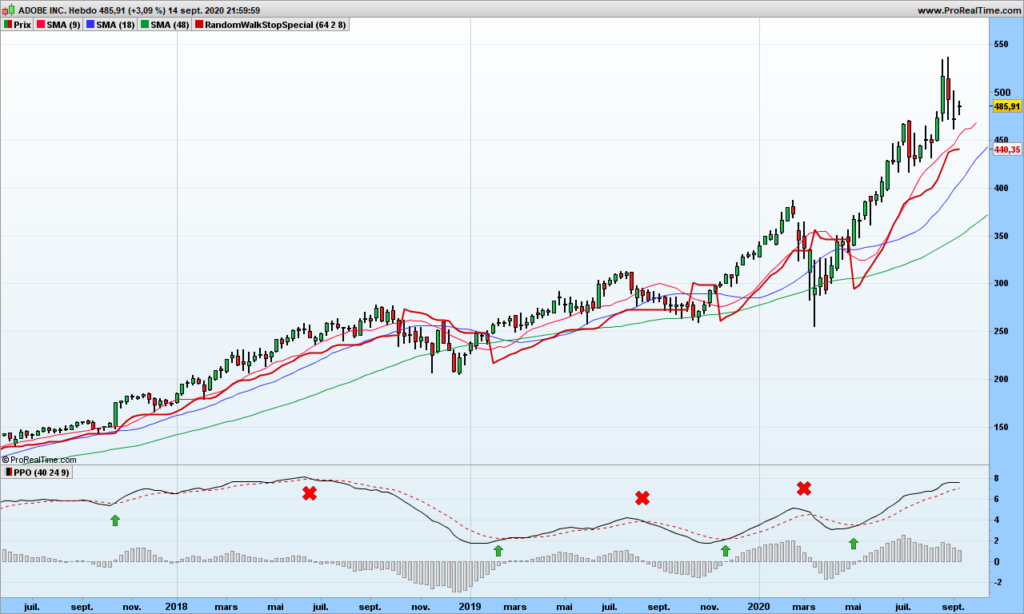

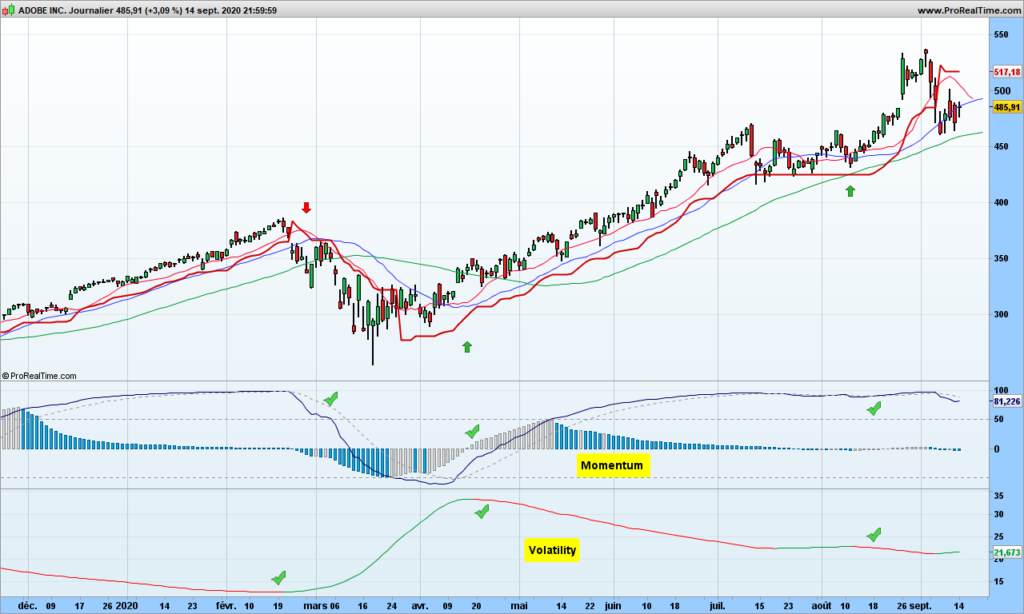

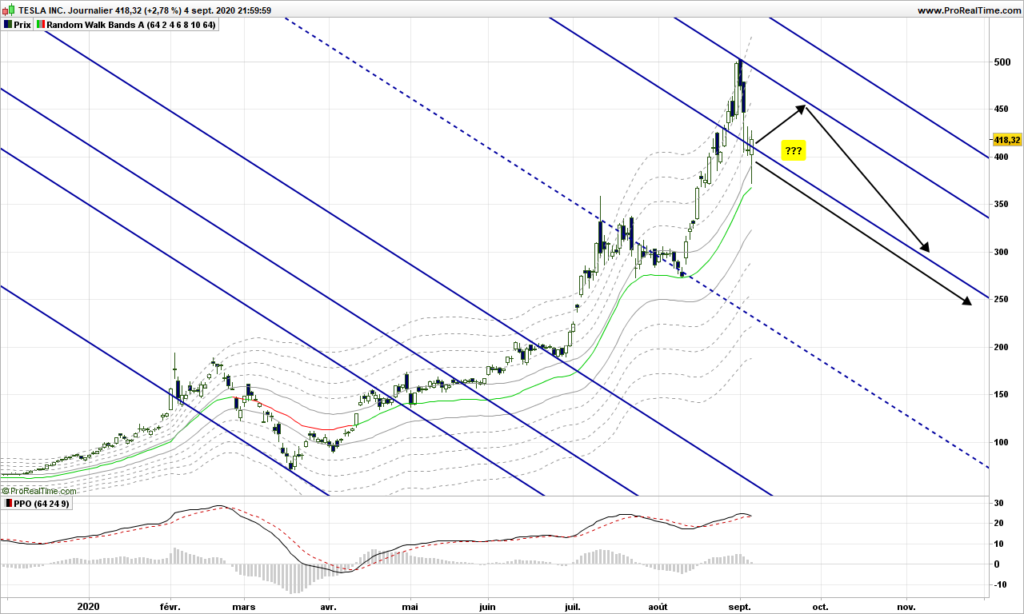

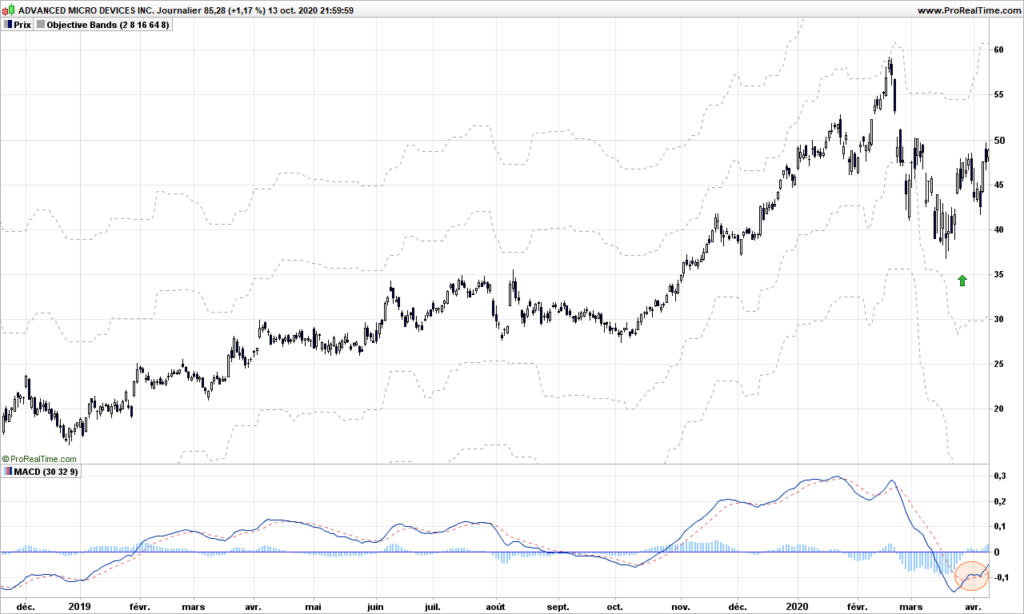

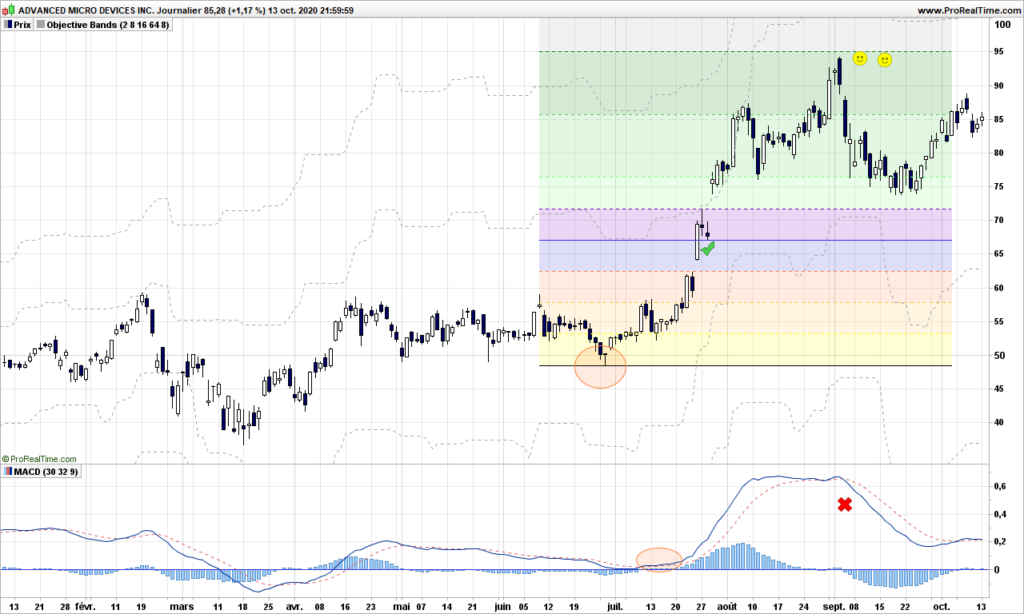

First step if course to detect the end of an existing trend (at least 2-3 weeks long), you can use MACD crossing over its signal for this purpose. See this example with AMD:

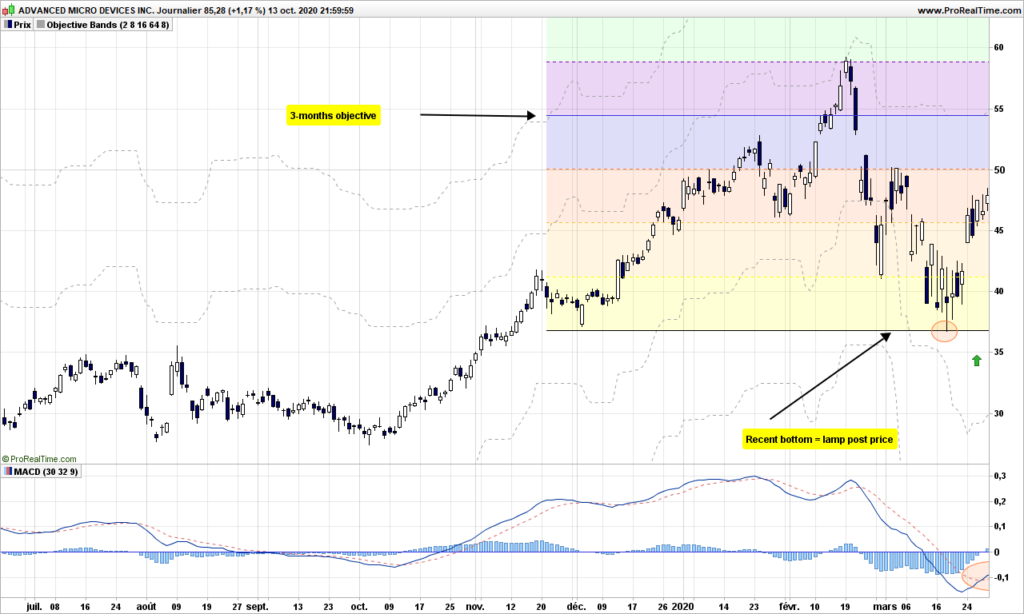

What the heck am I supposed to do here? We are obviously leaving a short down trend and we don’t know where market is going to go. Nobody does unless you can dig into the brains of all investors at the same time!

Again we assume the most recent bottom is a lamp post, from where our drunk guy is going to walk northwards, maybe in trending manner or in random hesitating steps. But we know about the objective he can reach within the next period of observation. This is the first dotted line above the candles. In this example, it is 8 steps away and we are going to draw lines every 2 steps.

Now we are ready, the 3-months objective is roughly 55$, you need to use a convenient stop to protect and dimension your trade. See this post for instance. Let’s accelerate the time now!

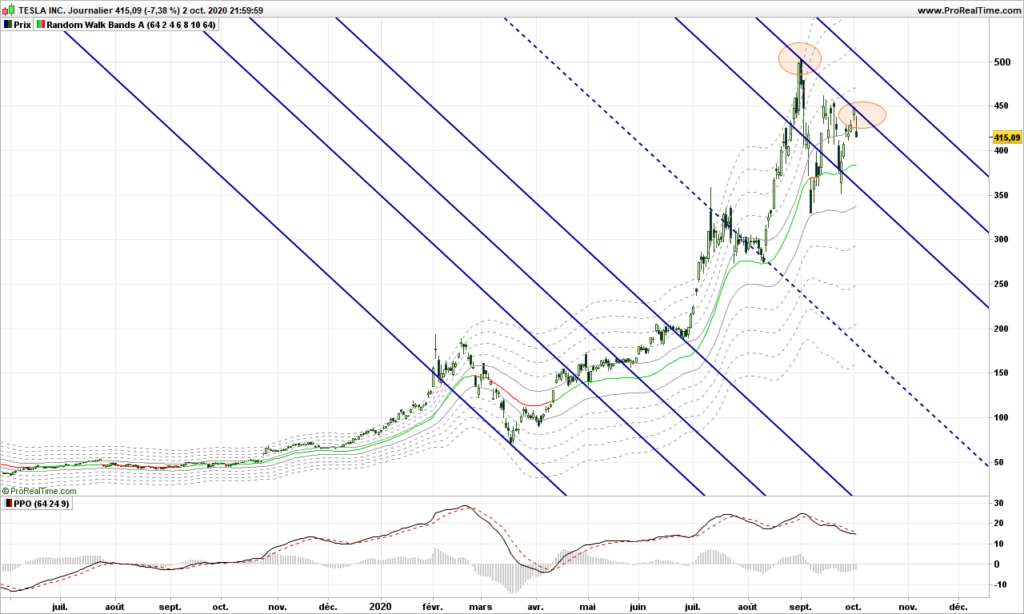

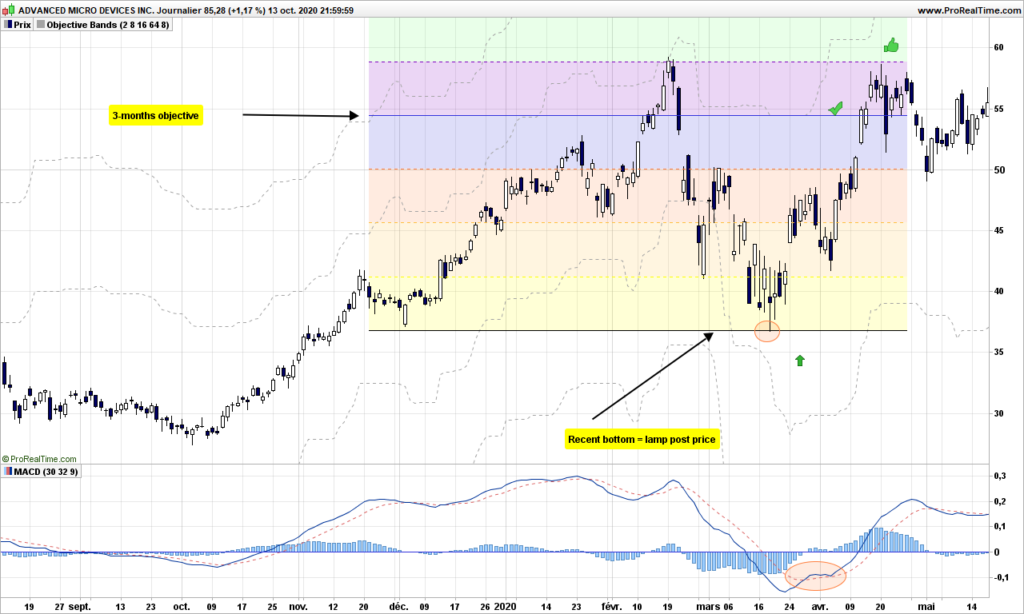

2 weeks later, objective is reached (8 steps), the drunkard makes it even to the 10th step. From there, market reverses, a new long trend does not really pick, so you can do the exercise in opposite direction:

This time the drunkard does not go beyond 4-steps and after 3 months, you need to give up your short play. Then MACD goes again above signal

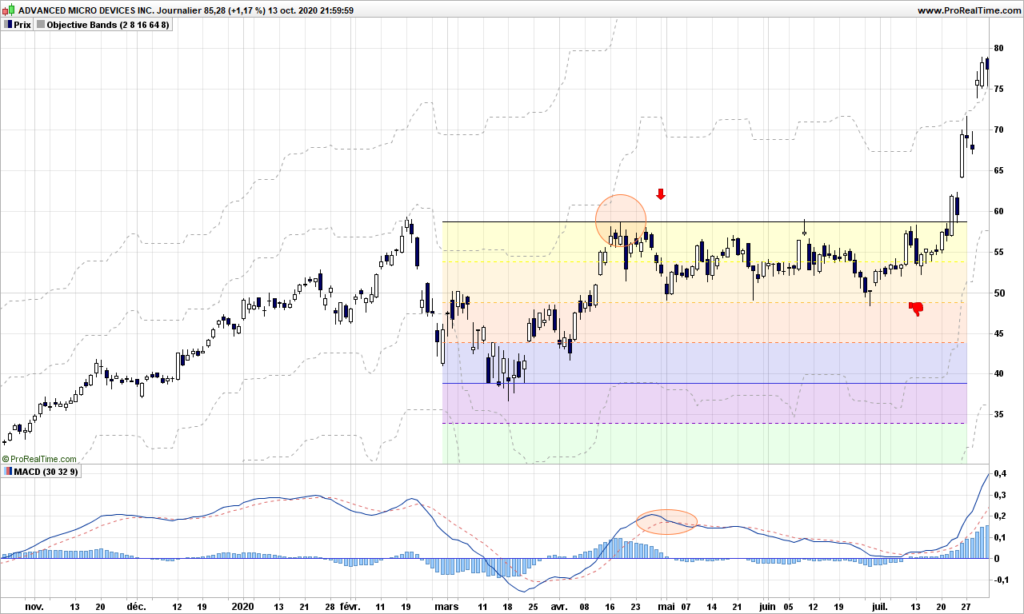

We reach first objective within 3 weeks, but this time the trend continues reaching 20 steps. You have successfully mixed together trending and random action!

That’s it. It does not need to be complicated. Don’t forget to choose stocks or indexes that have the capability to trend. Until next time, trade safely!