You know what? Communism has failed. Ecologist predictions of last 50 years have all failed. Big pharma have failed to find a vaccine against AIDS. Titanic has failed to cross Atlantic Ocean. Napoleon has failed creating a kind of European union. Romans have failed to keep their Empire together.

History is full of miserable failures but we don’t seem to learn from our mistakes. Nassim Taleb has found that somehighly improbable events ending up with drastic consequences could be due to a black swam. The idea behind if that you have never seen a black swam, you probably doubt they exist, not talking about predicting their showing up!

Was Covid a black swam? If you are a bit interested in big pharma history, you would know how they work. Their life would be very boring without epidemics, or even better pandemics where one can start making very good business with medicine, vaccine, medicine to cope with vaccine adverse reactions, improved vaccines, new medicine even long after the virus have completely disappeared. Since pandemics do not show up that often, it is best to create them, or at least let know all of us that there is one potentially very harming lurking by the corner of the street. This is what happened with AIDS, they said it was discovered in San Francisco, without giving any details, and then people started to get feared… fortunately this time, they could find a sellable vaccine. But how many times did they try? H1N1, Spanish Flu, …. No Covid is not a black swam, it has been long clear enough big pharma would try an other time to make big money!

Now if black reminds you of dark times, of morbidity, of whatever ghost stories, … all we need now is a big blue swam of hope!

Let’s be honest. Black swams are not that common but blue ones are even more rare, they will only show up if we all want it to appear!

Blue color is about hope, a bright future, water and sky, peacefulness, it brings positive values and tends to relax the eyes (try it, look at a blue sky!). We don’t want to talk black things any more: illness, death, mysterious societies, … As long as we play their game, they have the winning cards. If we have a strong positive message, they will be just ignored. Let me take one example: many doctors and health care workers have lost their job for rightfully rejecting the jab. What about they start a new life preventing people for becoming sick? Even communist party in China in the 1950’s pushed people to practice taichi chuan so that country is full of healthy people (that was before McDonald arrived in China). There is a lot to be built upon, it is not even secret!

Now let’s see if there is some positive news on the market!

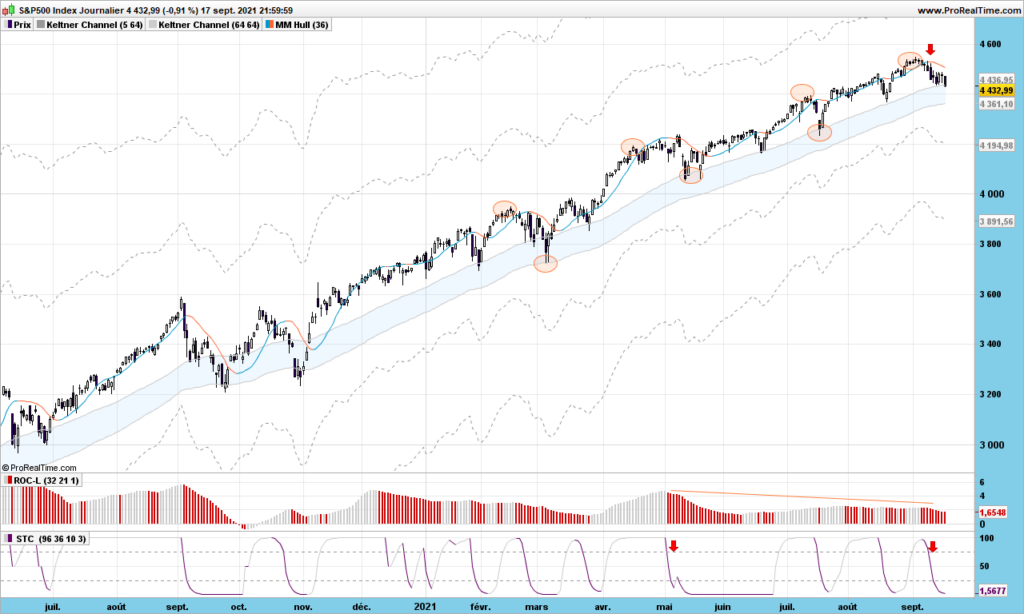

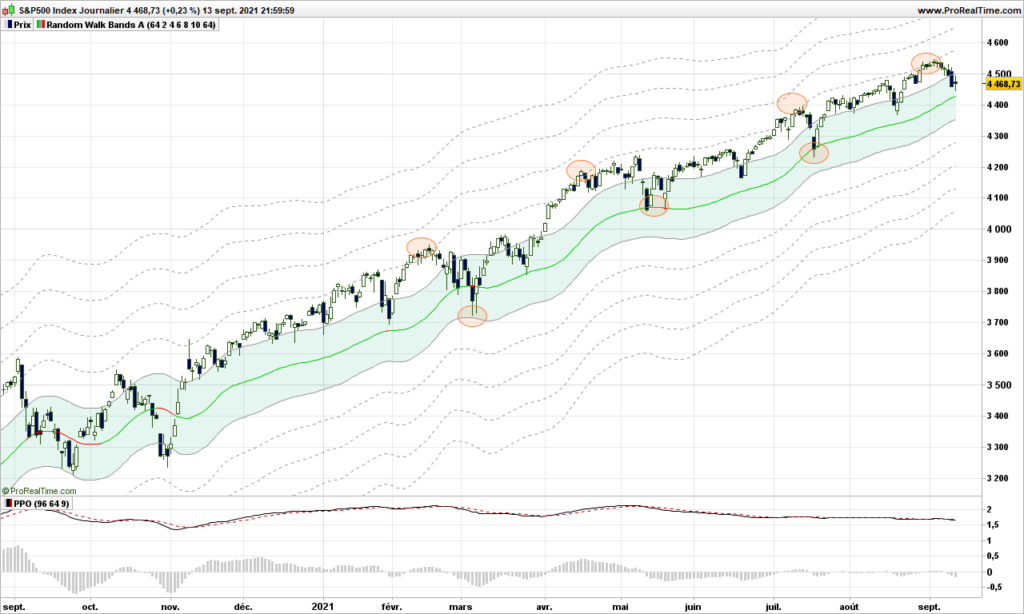

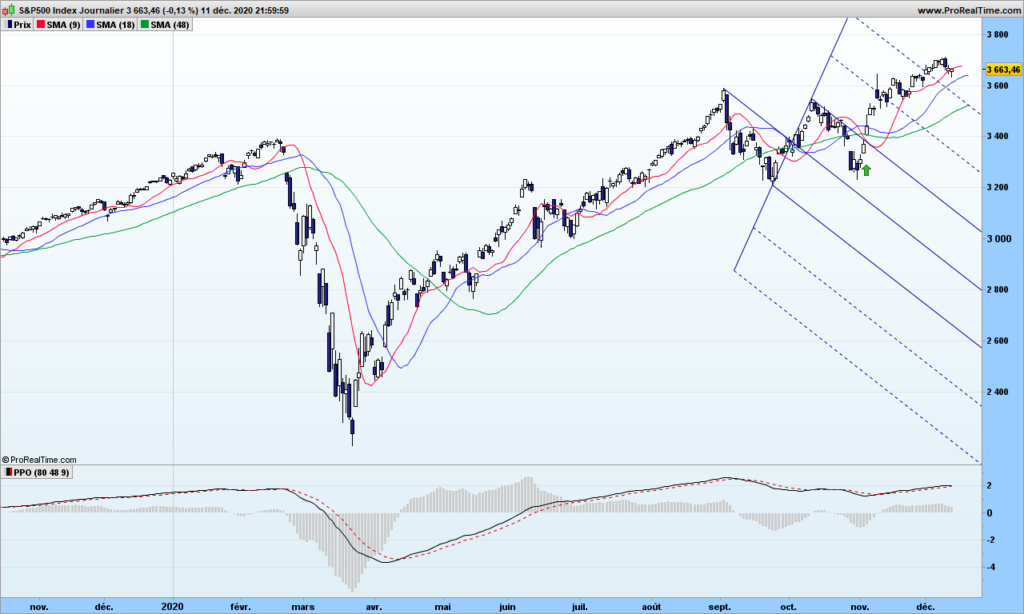

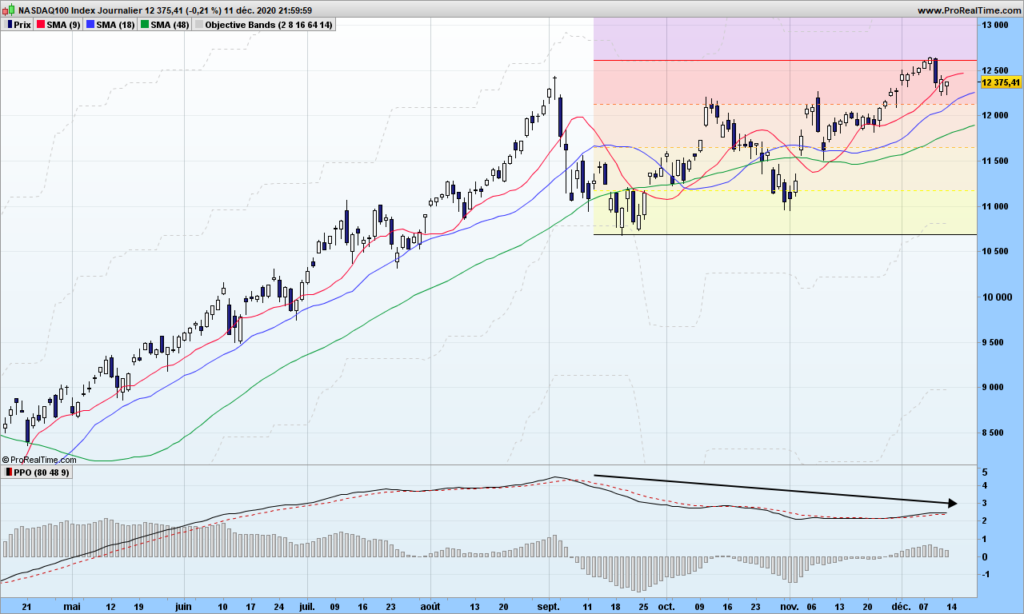

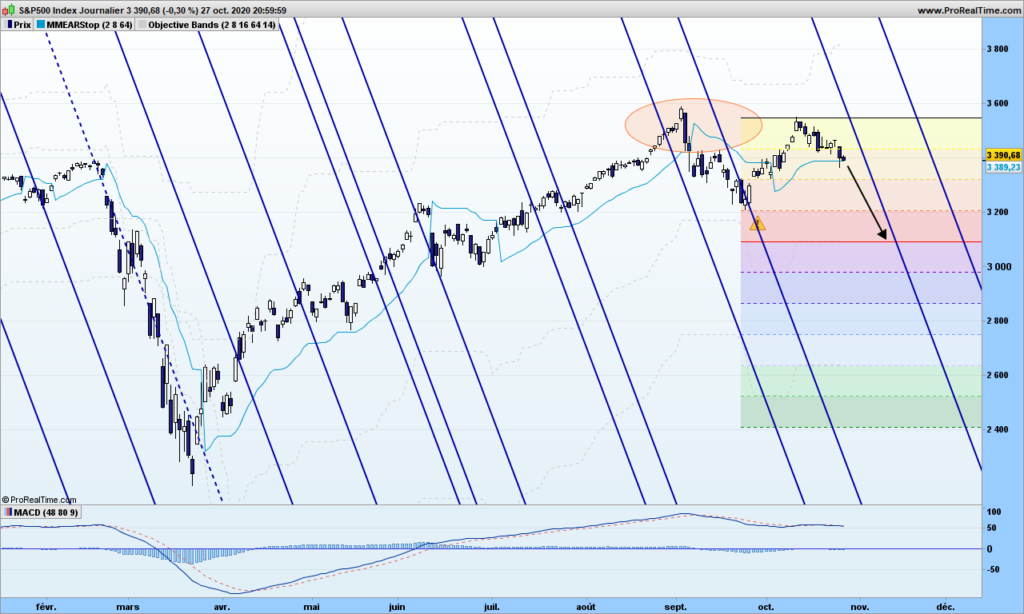

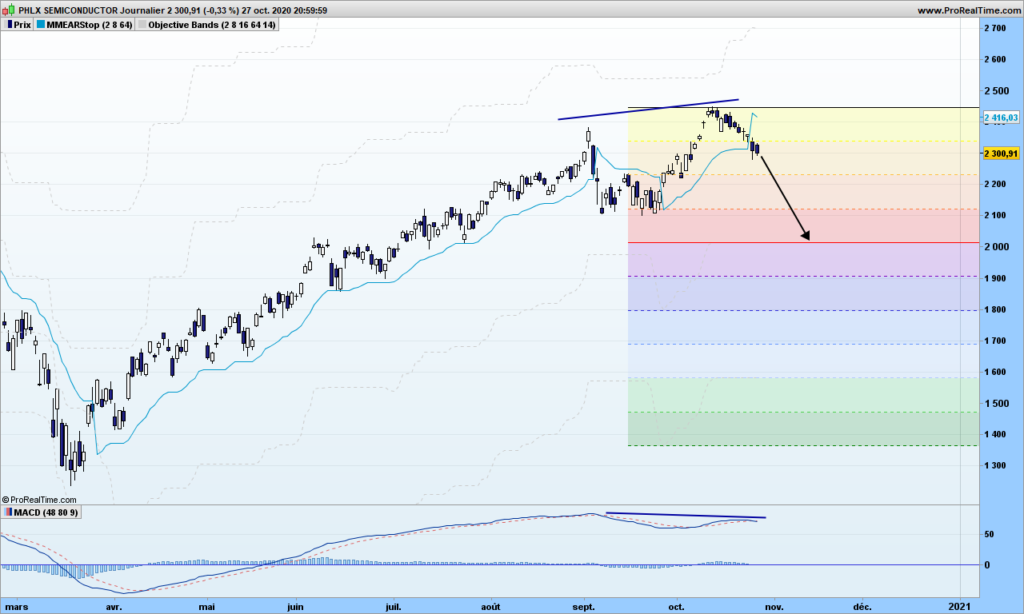

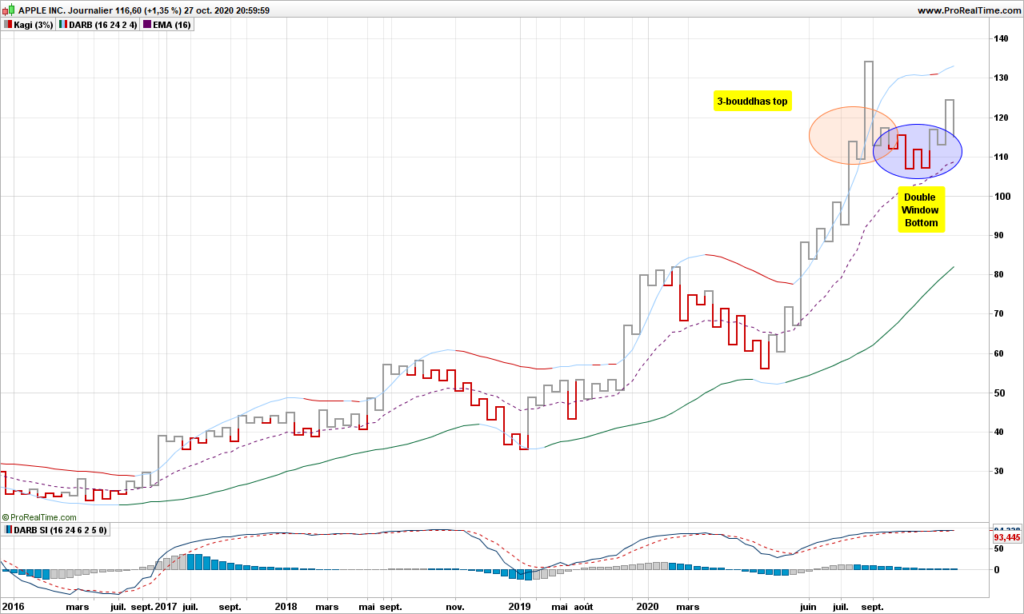

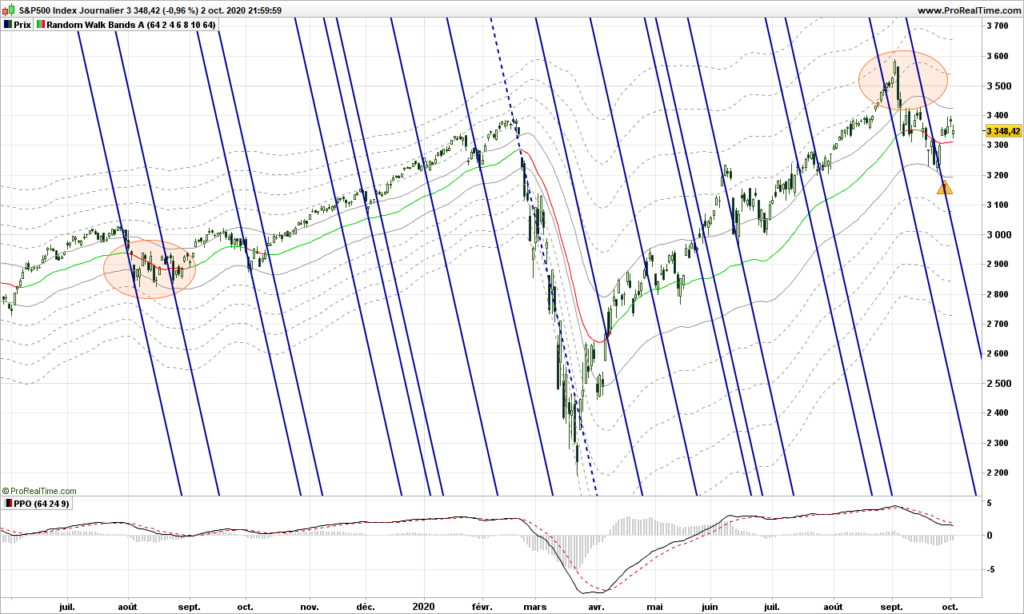

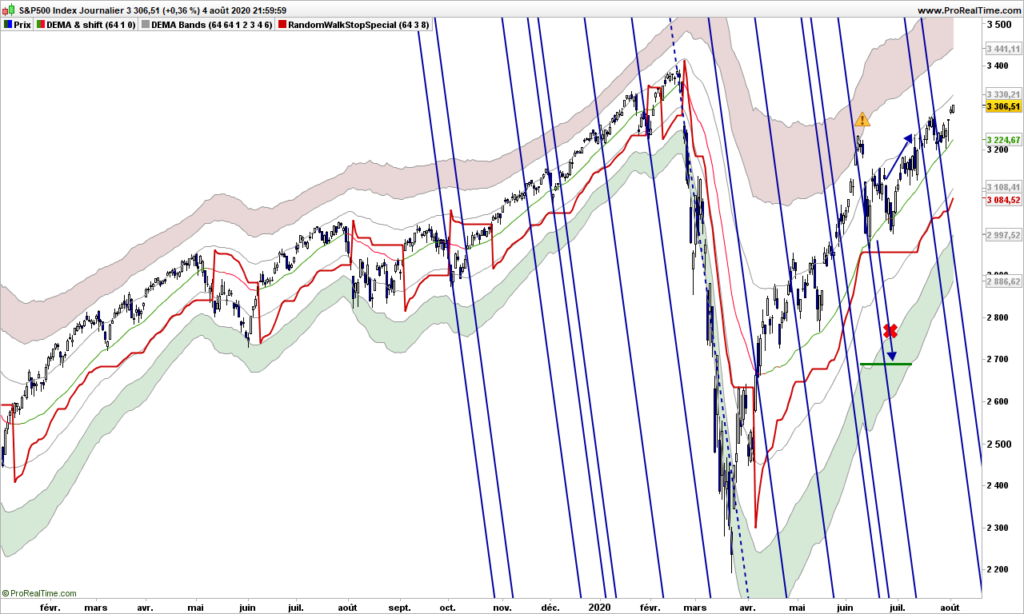

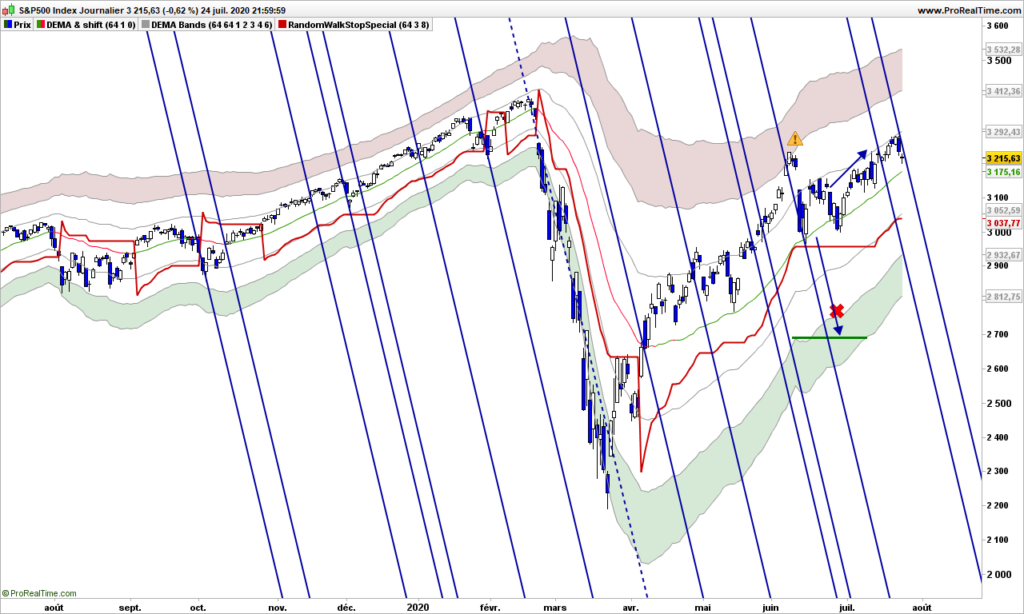

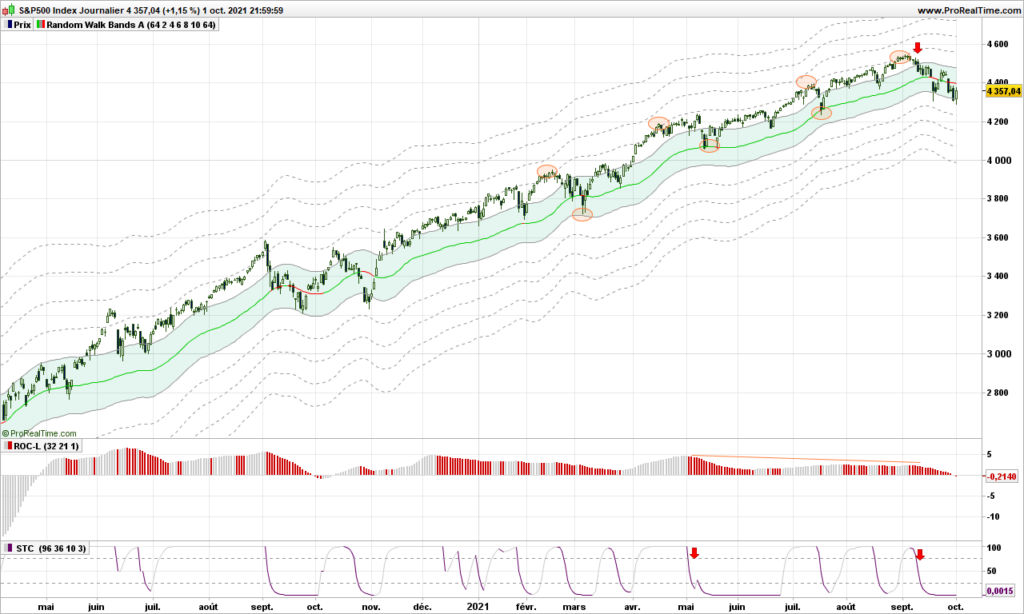

S&P500 seems to be taking a bearish turn. The smoothed ROC has turned negative but careful there are hidden divergence (which I am therefore not showing ;-)) We have to stay optimistic!

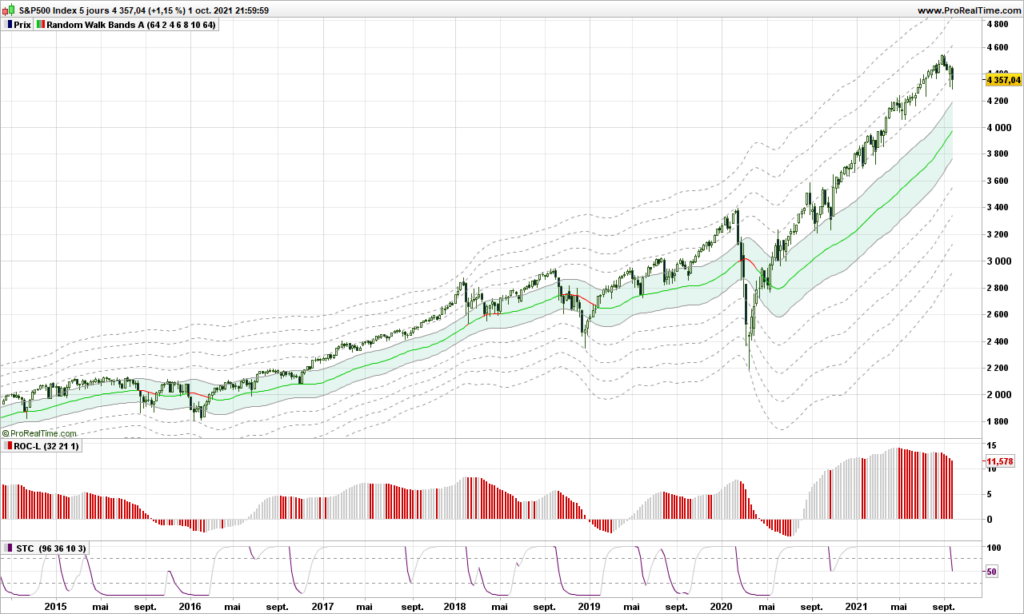

Just look at how nice the S&P500 has sticked to the dotted warning line on this weekly chart. If index returns to green line (the random walk path), everyone can understand the bullish trend is intact.

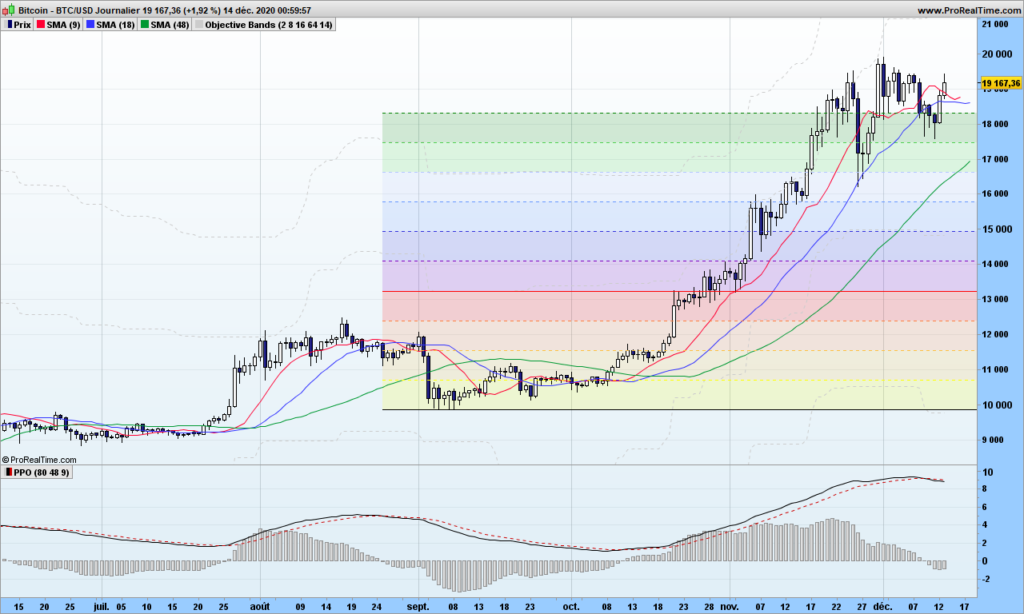

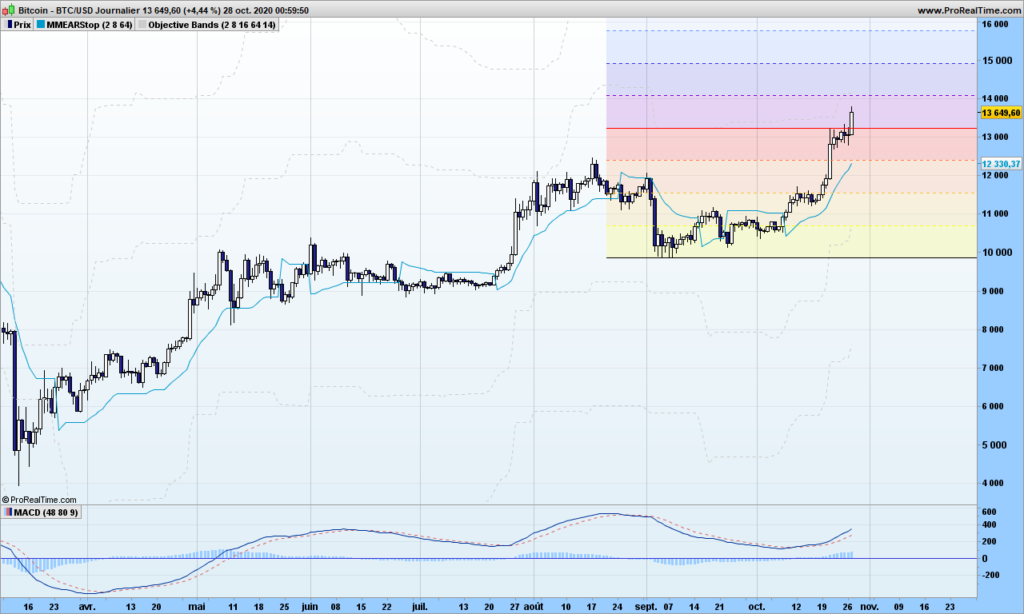

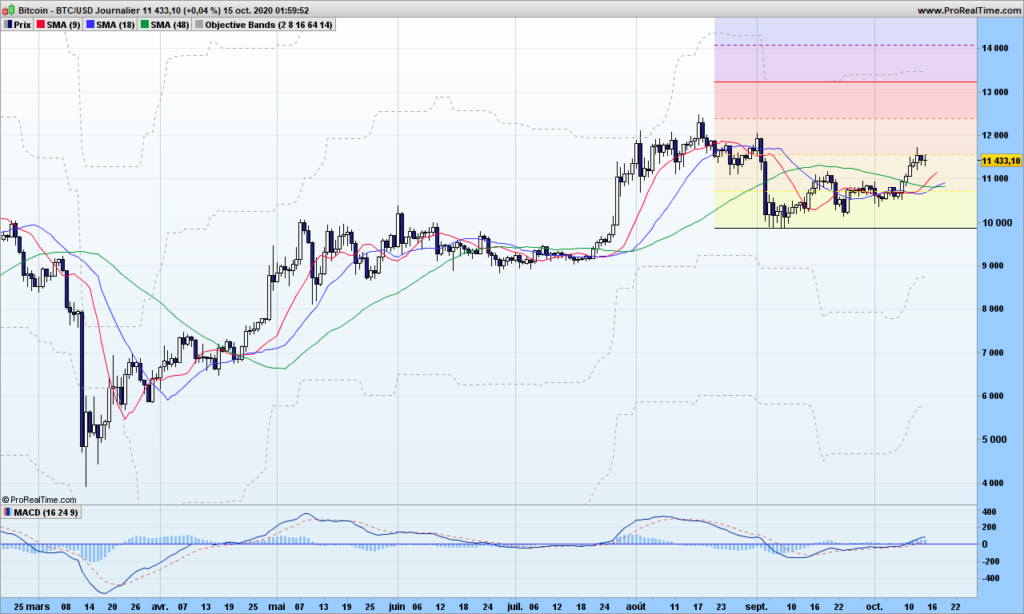

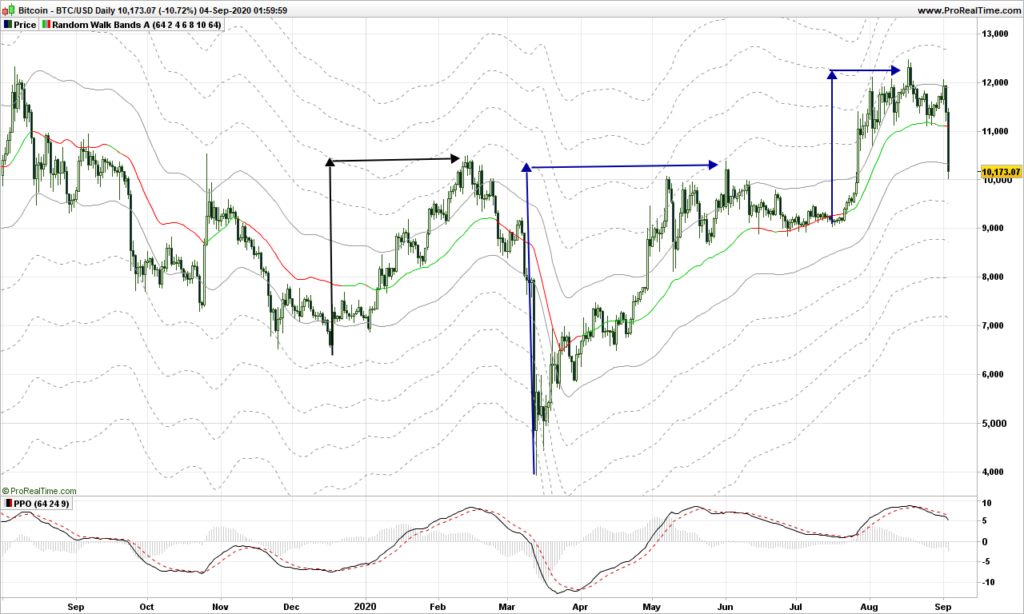

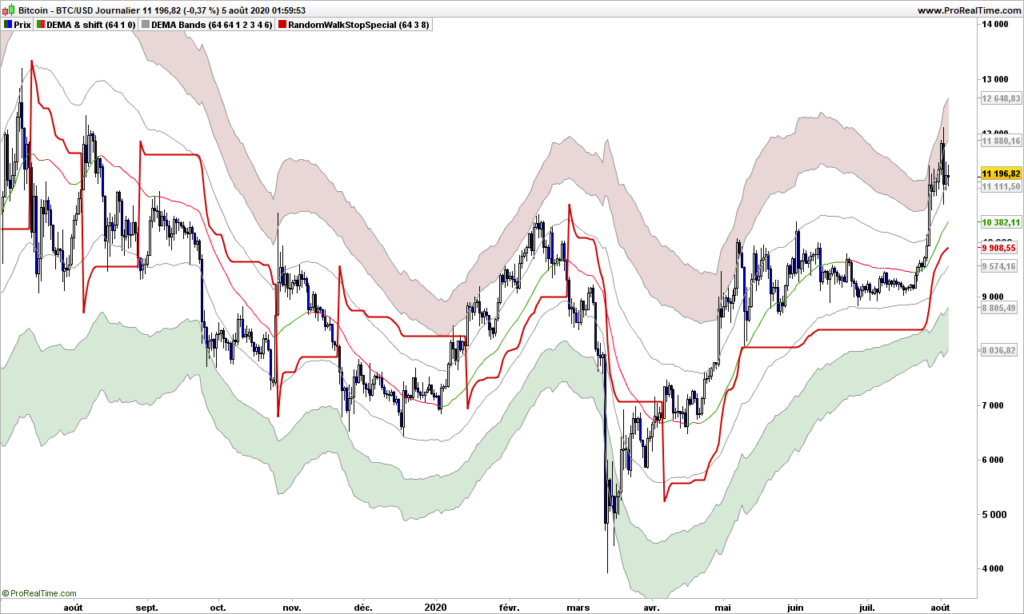

Bitcoin chart is unchanged. I have seen many Hoorays with last days price action, but be careful!

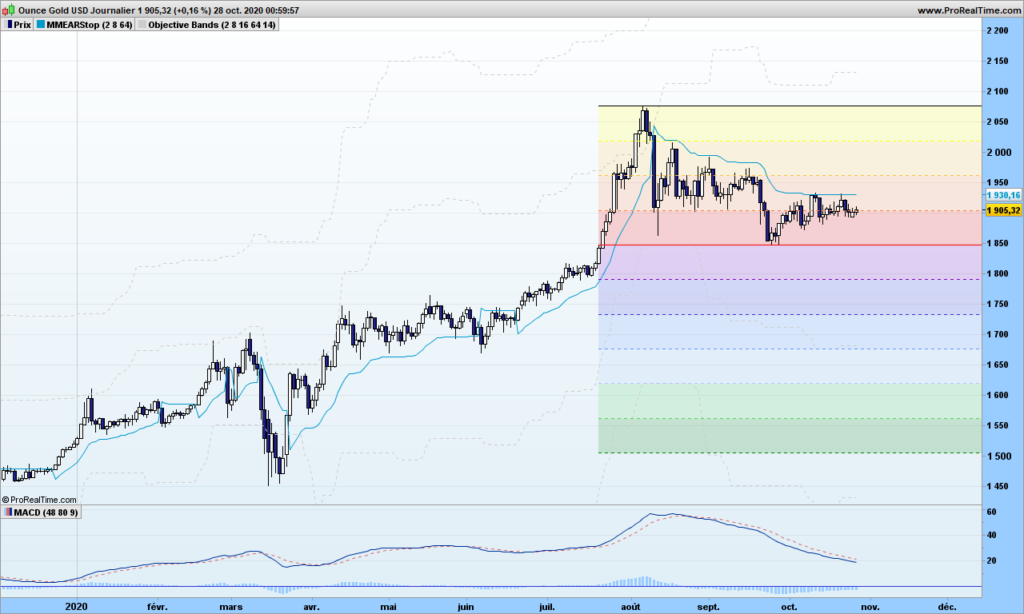

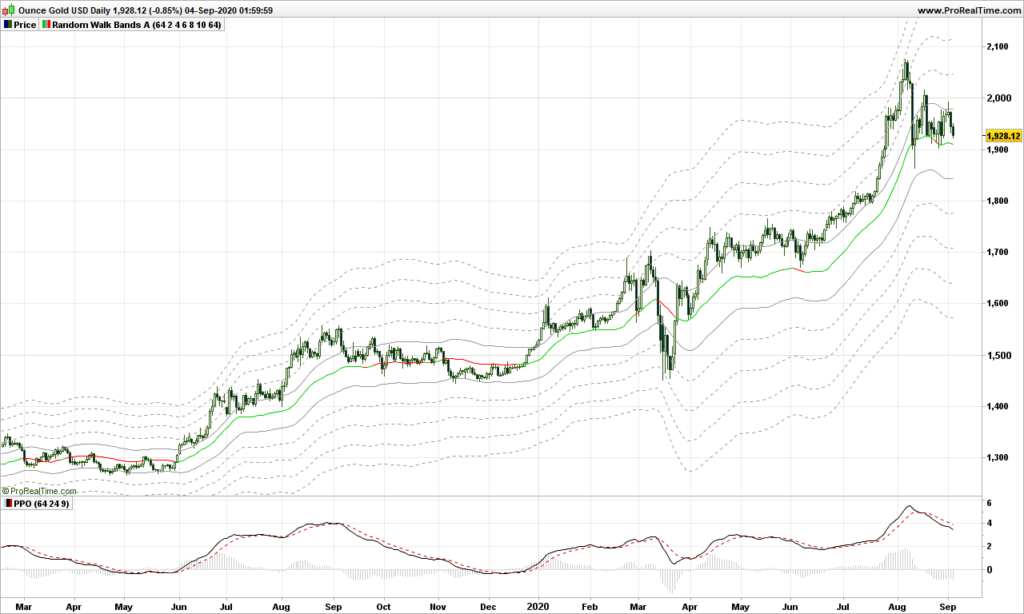

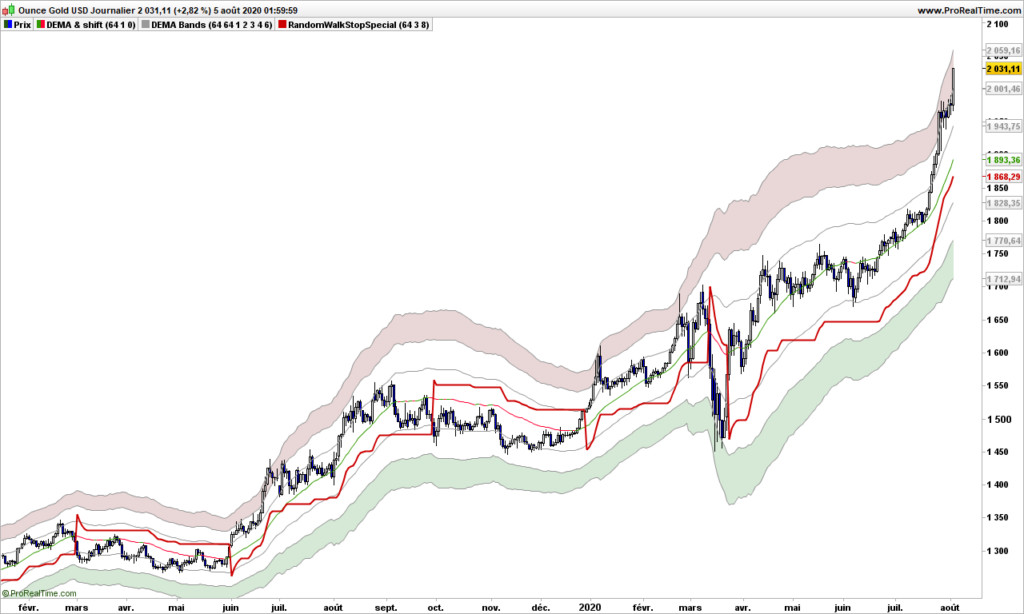

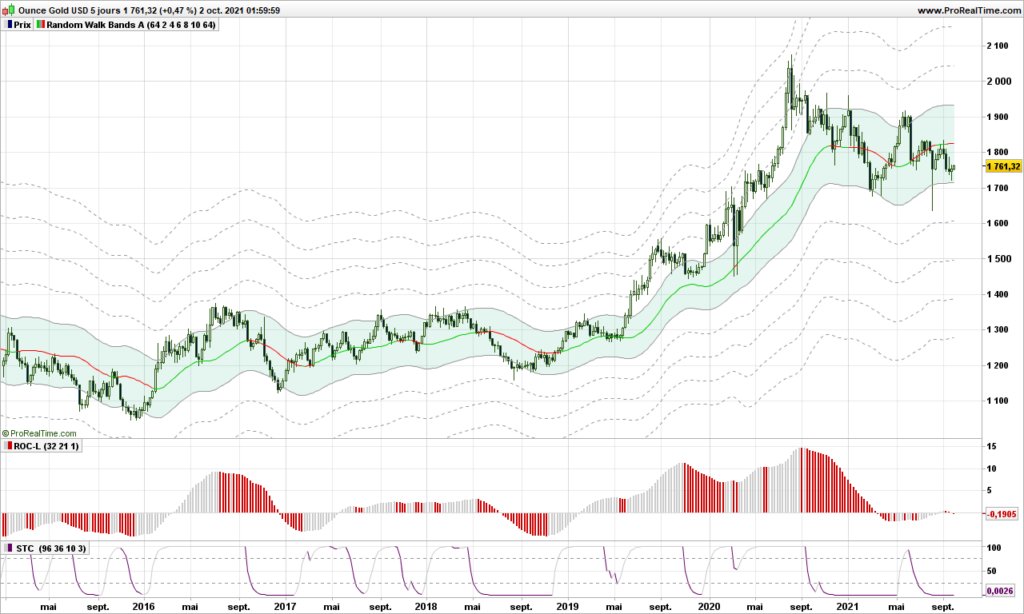

Gold is still is in a flat market. Let’s look at weekly chart just below. As long as the price is enclosed in the green area, you can take the opportunity to accumulate. Price is probably kept under control by institutions which think we are stupid enough and won’t buy gold at this price! You bet! Inflation is here, hyper-inflation will come sooner or later, we will see an other big financial failure, and everybody knows having gold is the safest way to go through any crisis. We have a second solution which is Bitcoin, I will write something about it in an other post.

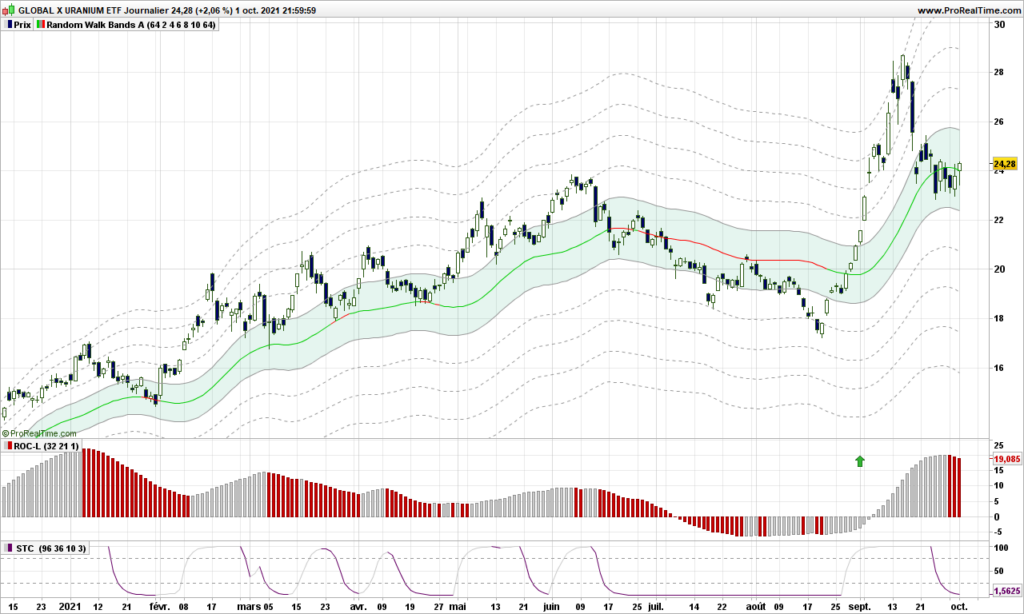

Uranium is one of them ressources to have these days, so I wrote a few weeks ago. It has gone up to one my highest warning lines. Now it is back to random walk path which is undoubtedly a nice entry area. As explained previously, wind farms and solar panels won’t do the work!

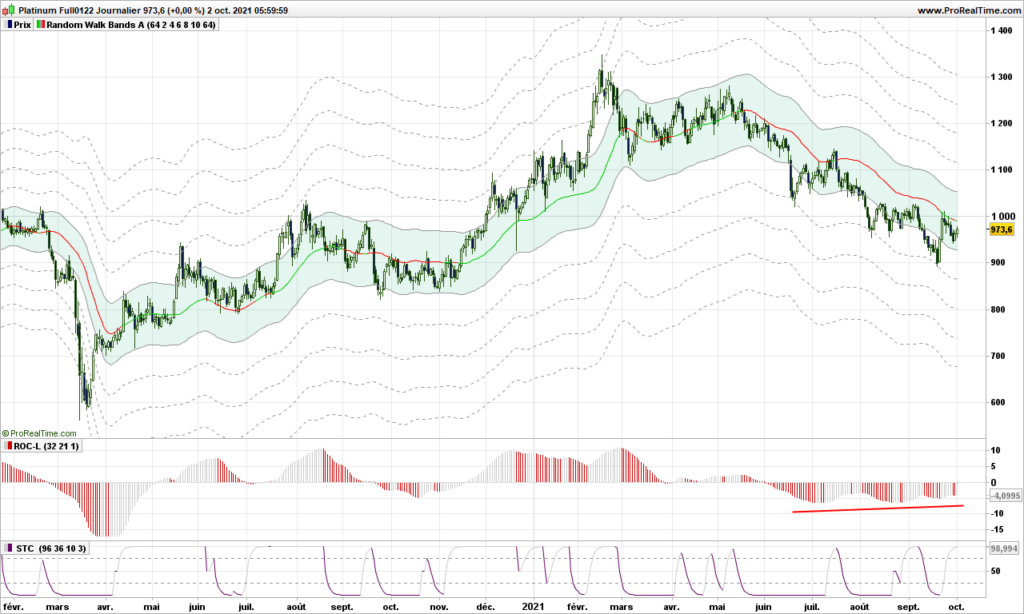

Platinium may wake up in coming weeks. Divergence with smoothed ROC, hitting the first warning line and buy signals on short term indicator. We are almost there.

That’s it for today. Aim at that blue swam! And until next time, trade safely!