You might think this post is about joking, maybe not so, but I will attempt to make you smile. We are living in a world that has gone insane because not only people are not thinking any more, but they also let others think on their behalf. As I have been advocating many times on this blog, thinking by yourself will let you see the light! Let’s go through many examples of current lunacy.

- Let’s start with mainstream economists. They are usually the laughing stock of deep thinkers. Now they are telling us that debt, whatever the size, does not matter any more because the cost is so low that the interests needed to be paid back are smaller than 20 years ago. Yeah right! But are we not supposed to pay back the capital at some point? And what if interest rate go back up? (because they will!)

- Ecologists are a cute little specie without brain and absolutely zero scientific or human psychology knowledge. They keep repeating what a group of idiots called Intergovernmental Panel on Climate Change (IPCC ) under United Nations Organization are saying. Those guys have established a correlation between CO2 level and Climate warming. It does not take long to look at raw data and see that this correlation does exist, but only from time to time! Data from last 20 years (average temperature has not gone up) is therefore ignored. Instead they claim that a 2°C increase by 2100 will be a total disaster for the planet (most of us will not be there to verify that claim anyway) and it legitimizes the attempt from Bill Gates to cool the climate by throwing chalk in the atmosphere, thereby …. choking (pun intended) in the process any existing life in that area. Totally insane. Why 2°C? Why not 1.5°C? or 3°C? Are oceans really going to immerse vast land areas (Archimedes would laugh at this idea!)? Relying on wind on solar energy only, will people accept to have electricity only during windy or sunny weather?

- Green growth is also a chimera. Electric cars don’t do more than fuel powered cars, so when you switch to ‘green’, you create jobs for electrical car manufacturers but delete many more with traditional care makers. Negative impact again!

- The pandemic and vaccine strategies clearly show how quickly our politician have reached burn out status due to smaller than average number of neurons in their brains! Imagine a vaccine based some technology born in the 1960’s but never approved for commercial usage, being suddenly approved for huge clinical trial…. It should make you wonder and investigate. The mRNA can modify your DNA. You are not eating transgenic wheat, right? And you want your genes to be modified without the knowledge of the impacts in 2 or 5 years? You are NOT a conspiracy theorist when asking questions, whatever they say!!

If you don’t know how to ask questions, go back to history and read old wisdom books. The old Chinese book ‘Tao Te Ching’ will definitely ignite brain power, then continue… there are thousands of books to read. You will also find that strong limbs, biceps, triceps, … muscles are best tools when coping with stress wherever it comes from, some Daoyin (Chinese) movements will help you think more clearly too! You may also humbly read again previous blog posts such as this one about challenging assumptions…

How long will it take you to switch on the light bulb? That is the question!

You may end up with different conclusions, those are mine:

- Dismantle those idiotic and useless organizations such as IPCC mentioned above, but also IMF, WHO, WEF, EU, … because they are led by insane people.

- Dismantle Facebook and alike which make you waste your time without being paid back, and prevent you from thinking by yourself!

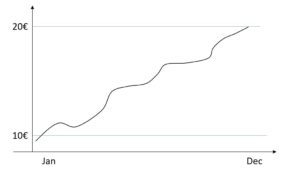

- Spread sound culture, always get back to basis when needed. Have a good relationship with money

- Prevent finance from playing with money or our savings. French Bank Societe Generale currently wants to issue a product made of a bond and an option, all secured by Tezos blockchain. When it all fails, they will blame crypto technology!!

- <add your conclusions in the comments!>

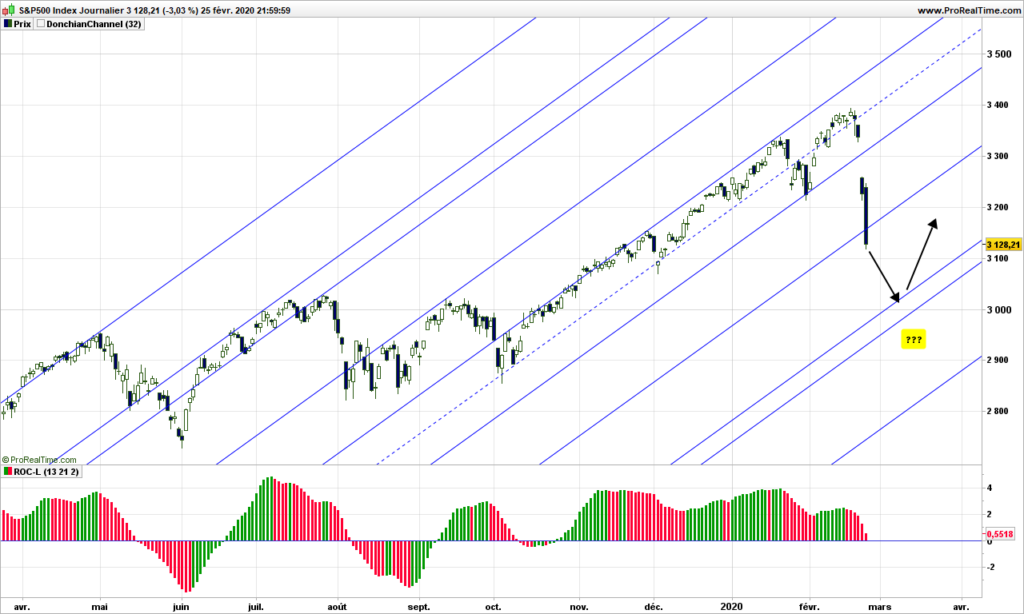

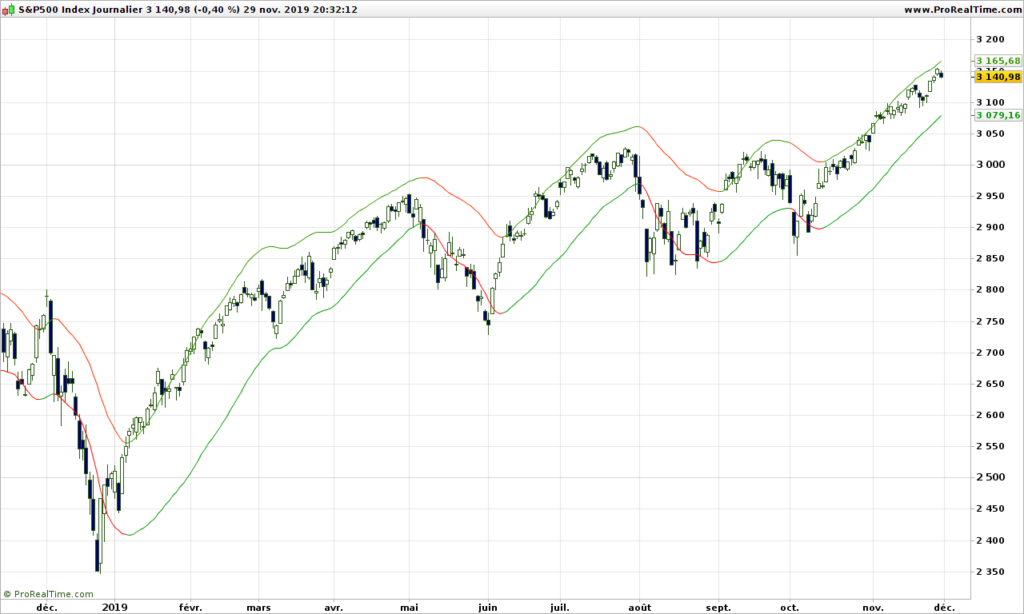

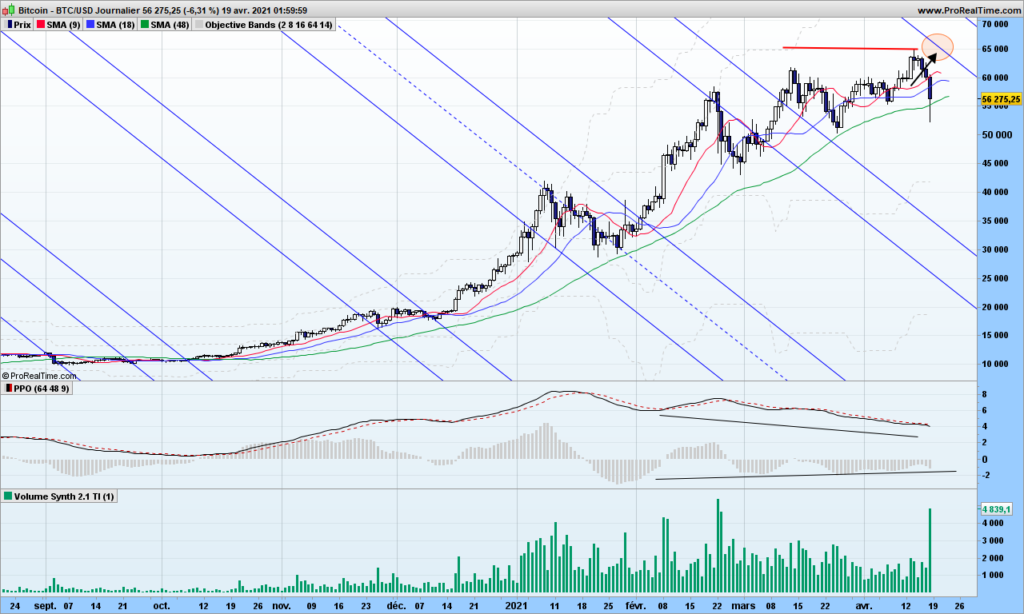

Let’s finish this post by a look at Bitcoin chart. Yes Bitcoin is possibly a kind of Ponzi scheme where new entrants are paying for those who want to get out. But, by blaming Bitcoin and other crypto currencies, the crypto haters make buying opportunities for open minded traders who are trading, not investing in the long term (HODL). For as long as crypto’s are allowed, then there is profit to be made!

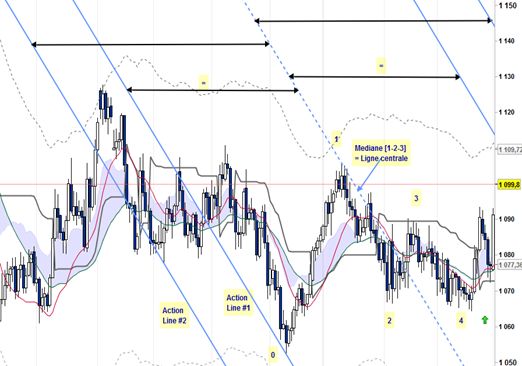

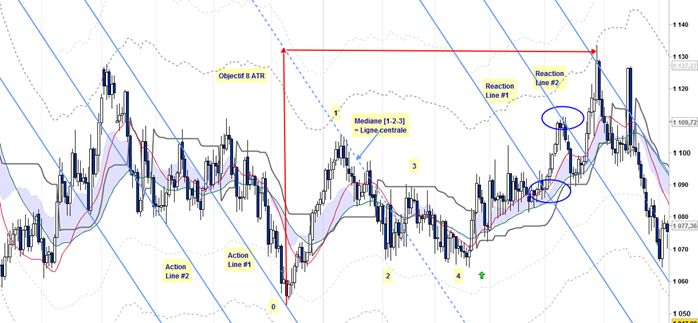

My red objective was reached (64891 vs 64808 calculated!) even before reaching the reaction line. Hidden Divergence with MACD, moving average still pointing north, and more than average volume points to a recovery in coming days but we have to be careful. Closure under 52k and I am out for the short term. On the longer term, I am out under 46k.

That’s it. Until next time, use your brains to trade safely!