Today we will take a quick look at most popular, most used indicator, but I have never understood why traders give it such value! Let me give you some tips to make it interesting. We are going to use Facebook for our study!

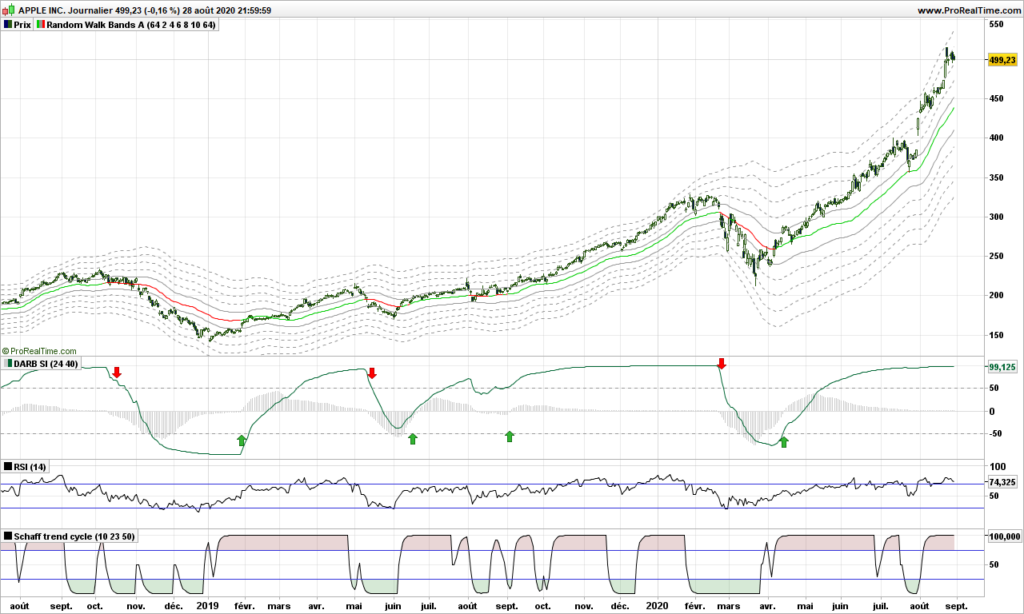

On the graph, you can see RSI indicator at the bottom, just below our customized MACD. It looks very noisy especially with default parameter 14, but since it is an oscillator (as opposed to trend indicator that MACD is), you may spot better synchronization with market tops and bottoms. If you can’t see, move your seat away from your screen, a bit more, even more… can see now? Good… The blue lines indicate the overbought and oversold levels, which, as you can see, are not reached very often!

So what’s wrong? The problem lies in RSI formula:

RSI = U / (U + D) where U is average of up moves in last n days, and D average of down moves over same period.

As I have previously demonstrated, market is a random and existence of trends is the proof of its randomness. So where is the link between this formula and random nature of market? The calculation could give similar results whether all the up days are consecutive or not, so with totally different market configurations. So, yes, it may work if you are very short term trader (a few days at most) and work out the divergences, market tops and bottoms, and decide what to do about it.

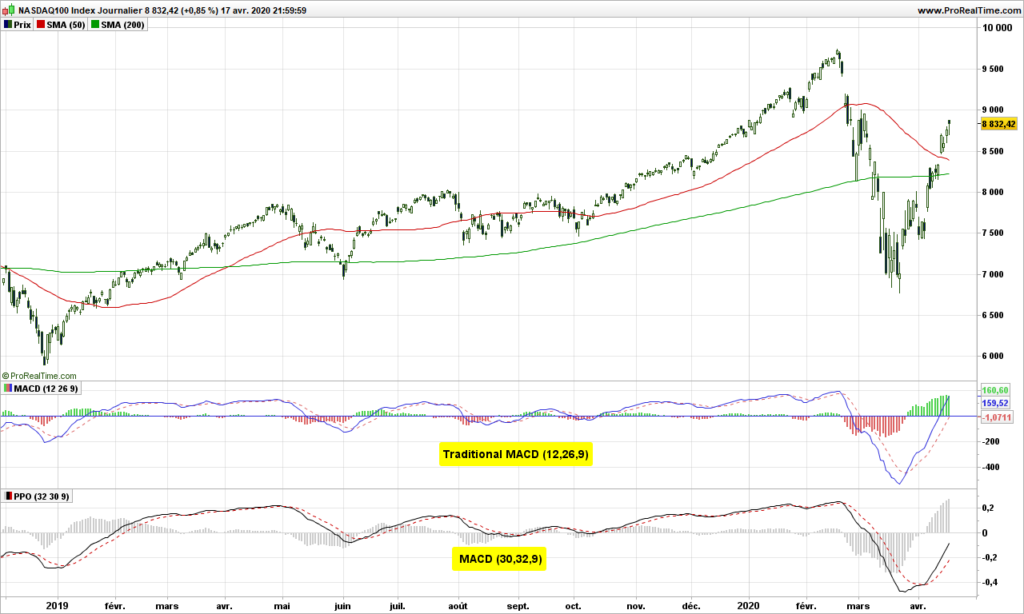

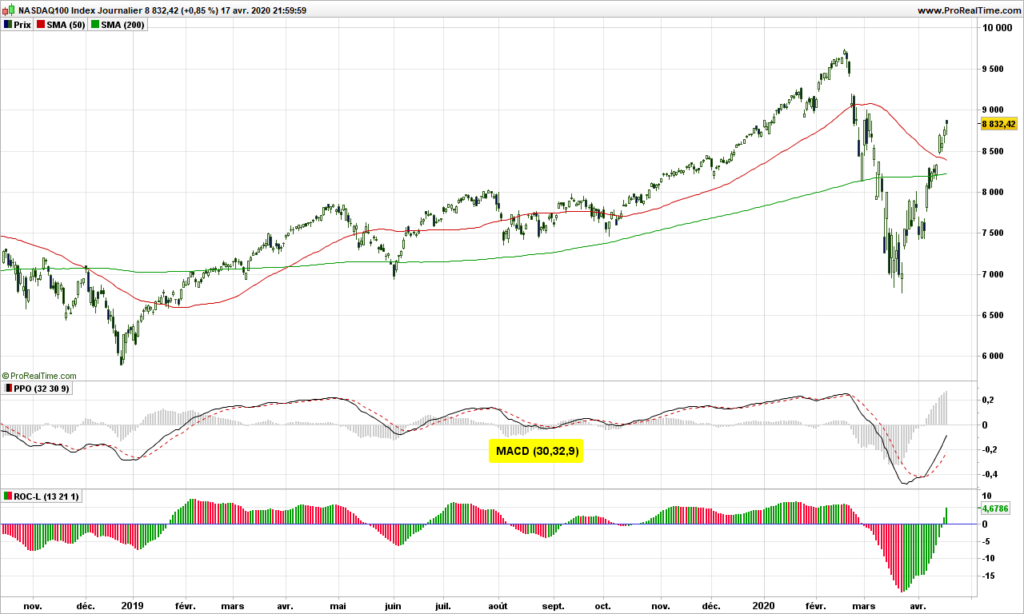

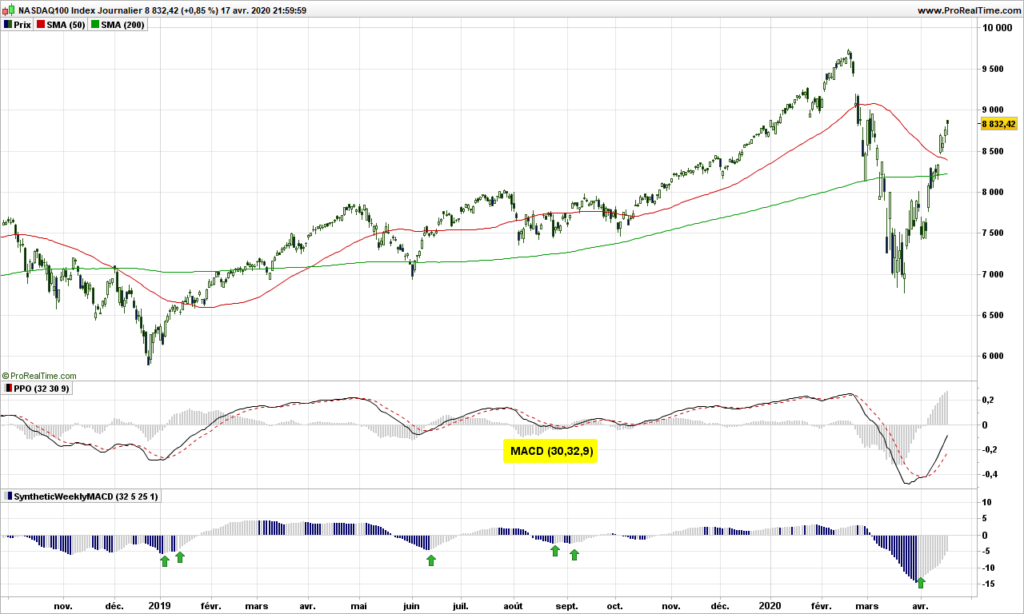

Could we modify it for more interesting usage? Of course! We can even use it for trend trading. Just replace delta between today’s and yesterday’s close by the delta measurement on your favorite moving average!

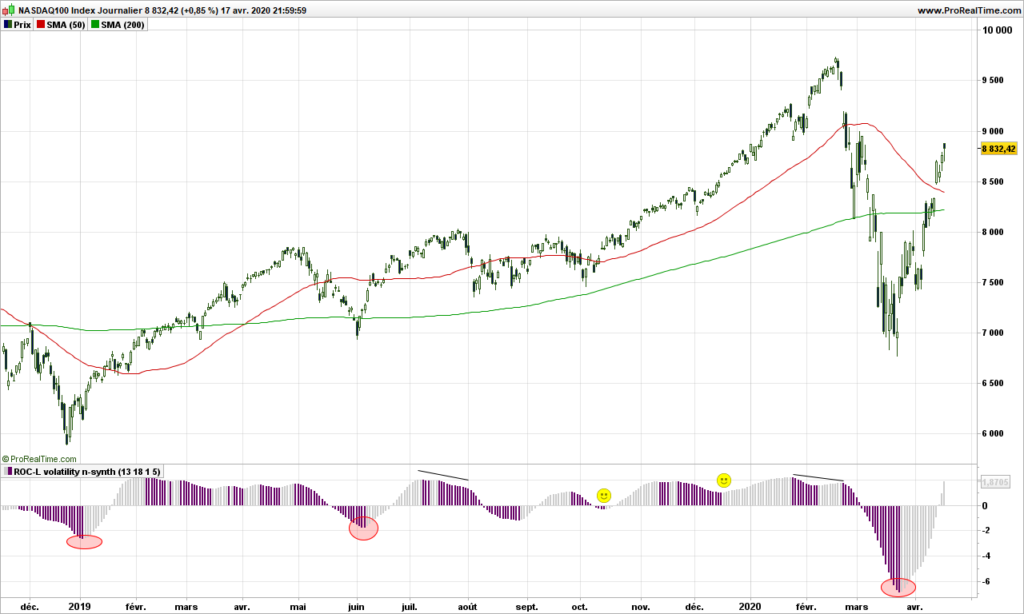

Now look at this new indicator. Buy signal is generated when improved RSI (iRSI) crosses above 50. You will notice it goes straight to 100 and stays then there until exit time. Easy, isn’t it?

As usual, use a stop to secure your gains. You may also define overbought and oversold areas at +30 and +70 if you want to stay with the trend as long as possible. False signal do exist of course, and there are 2 on the graph; the moving averages tell you not to go!

That’s it. Until next time, trade safely!