Now that most of you have read all the blog, your neurons are ready for experimenting new sensations! The indicators from the old world, such as RSI or MACD, have plenty of issues but are nonetheless used by professional traders, because if you can trade with candlesticks, RSI and 2 simple moving averages, then indeed it requires lots of training and experience to become profitable. They call it price action analysis!

If you don’t have 10 years to dedicate to training, then consider any old indicator and how it could be improved to give you less false signals! That’s it!

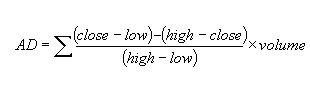

Let’s take the example of Williams Accumulation Distribution. It is supposed to be traded with divergences, but those do not appear quite often. Let’s have a look at formula:

This is the original formula defined by L. Williams. It contains volume information. First problem is that volume information is not always available (e.g. for cryptos) and second one is that many transactions take place outside the stock market, so we get only a partial view!

Steve Achelis improved this formula with this adaptation:

1. Calculate True High (TRH) and True Low (TRL)

TRH = Current bar high or precious bar close, whatever is higher

TRL = Current bar low or previous close, whatever is lower

2. Calculate current bar Accumulation/Distribution:

if Current close is above previous close then

AD = Current Close – TRL

if current close is below previous close

AD = Current close -TRH

if current close = previous close then

AD = 0

3. Calculate Williams Accumulation Distribution which is calculated as cumulative total sum of AD values

WAD = Previous WAD + AD

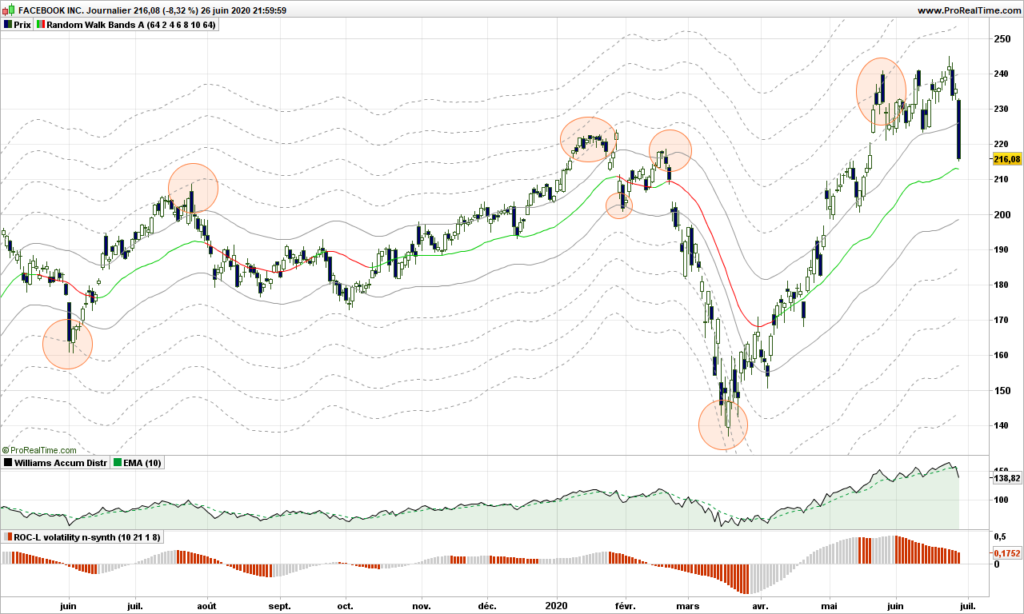

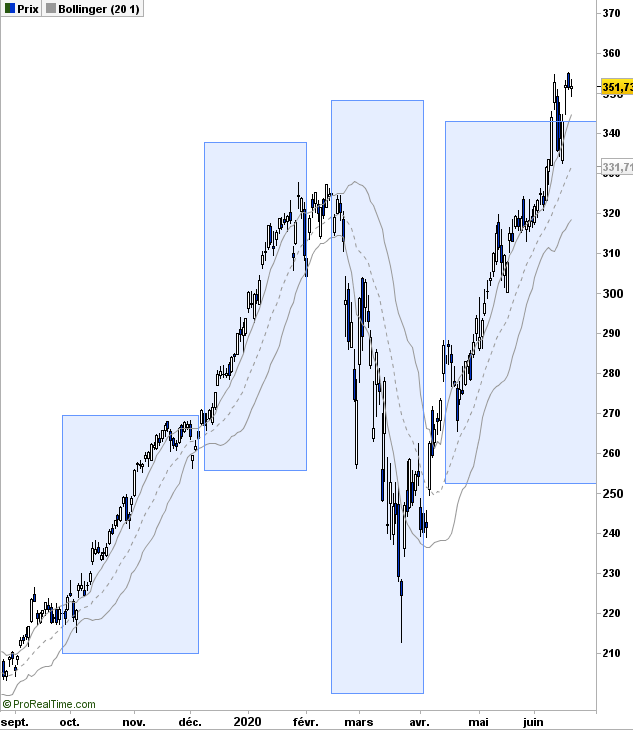

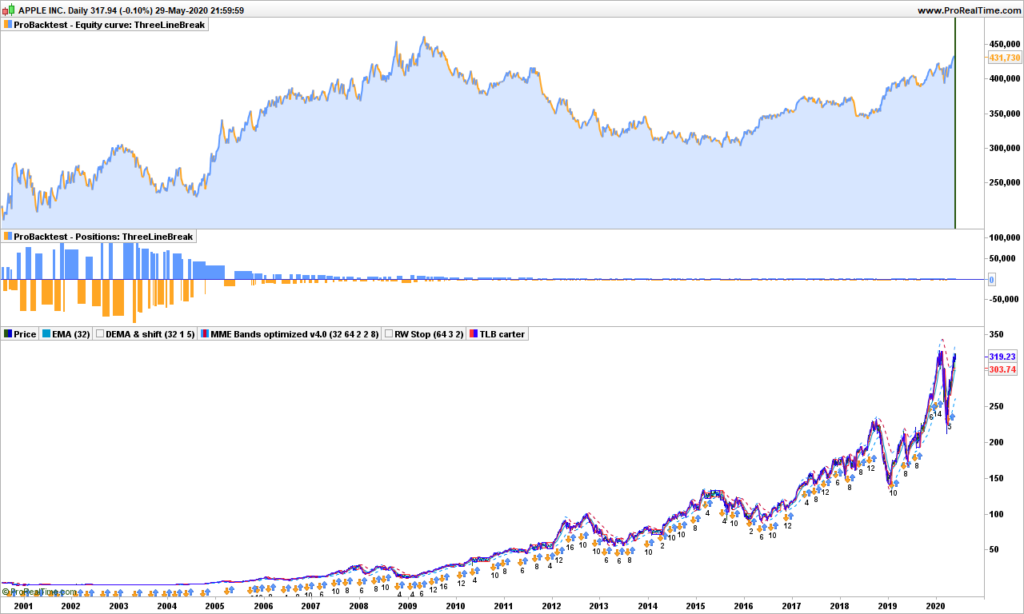

Here is how it looks:

Without divergences, the indicator is useless, or is it?

The point is that most indicators stop to work when too many people are using it. Market likes to play with your nerves! And if you want to program the ups and downs in automatic trading, well, good luck!

There are surely multiple ways to improve this and here is one!

First thing is to smooth this indicator, but not with an average! C. Kase (see here) has introduced the concept of synthetic weekly indicator. The change in the formula above is straightforward and we are going to use n days instead of just 5 days as implied by the word ‘weekly’

Just make the following changes:

- Close is unchanged

- Open is the opening price of n days ago

- High is the highest of last n days

- Low is the lowest of last n days

See how much smoother it is? You don’t have to worry about using 5 or 8 days as in the graph above, because indicator is evaluated every day! On a 8-days chart, you would have to wait 8 days to get a new candlestick, but here you might get a signal as early as there is something significant!

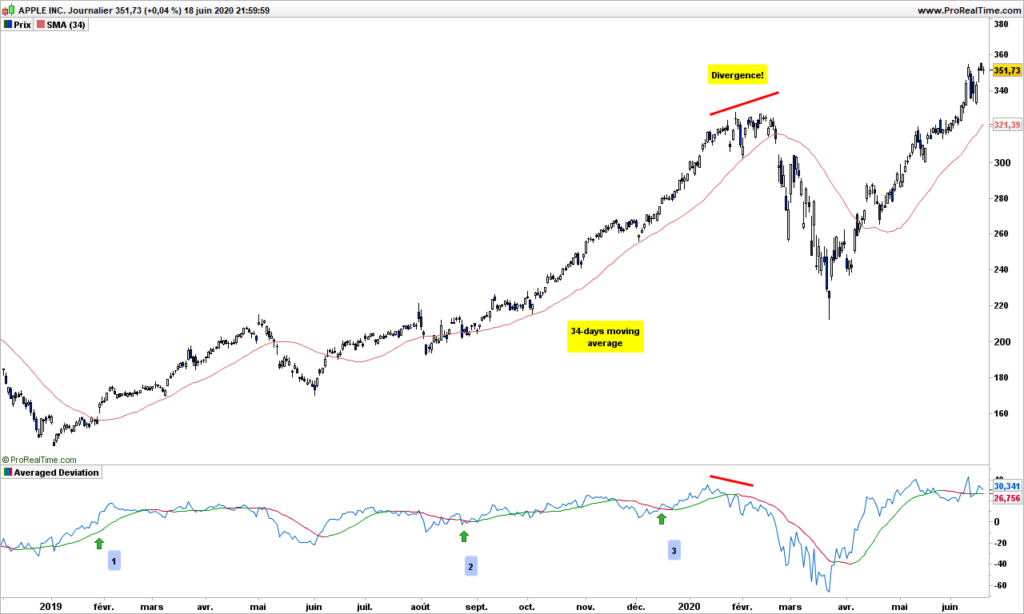

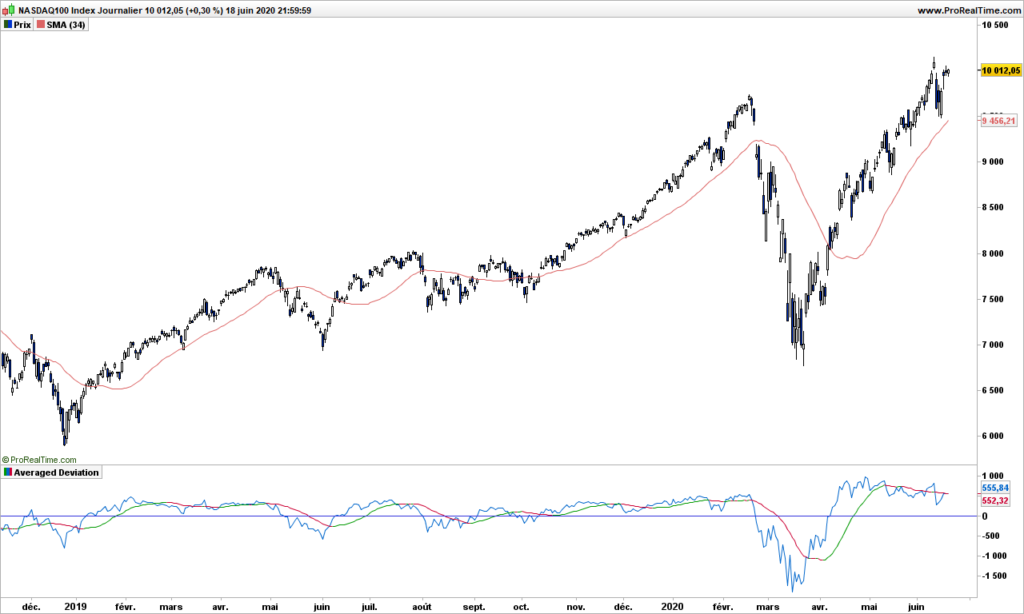

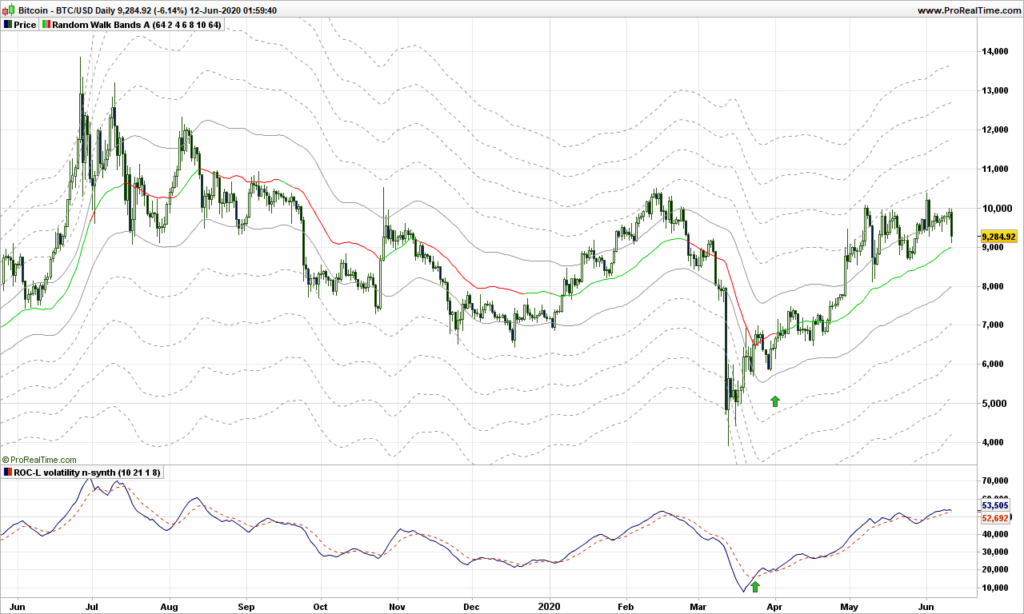

OK sir, but we still see no divergence? That’s right so let’s go one step further and calculate the smoothed ROC of synthetic n-days WAD!

The smoothed ROC is simply the Rate of Change applied to an average instead of raw indicator. I have considered a 10-day EMA of the WAD and 21-days ROC. Here is the fabulous totally refreshed indicator:

I colored the SROCSynthNWAD (or more simply WAD2.0) in grey when going up, and red when going down. As you can see, indicator is above 0 when trend is up, you have additional entry point by color change if needed and (some) divergences appear from time to time! It is so smooth that you can program it easily in automatic trading system!

Your task is of course to evaluate it over many stocks or securities, over long periods of time, over multiple time frames, ….

This is of course just one way to do it. Maybe you can work out an RSI2.0?

That’s it for today. During next 2 months, I will only post markets commentaries from time to time. Enjoy summer time and stay away from harmful viruses!

Until next time, trade safely!