I will attempt in this post to make the bridge between statistics and probabilities in the lightest possible way! This will position us with the right mindset when trading!

All what I have written so seems to be fine with you, and therefore if you want to convince me to follow you on a trade idea on ‘Thin Air Company’ (TAC), you need to give me the following information:

- When to enter? At which price?

- What is price objective?

- What is the exit strategy?

- What is the probability of success?

Last question might seem very puzzling to you because of one of the following reasons:

- you don’t have statistics about your trading methodology because you can not program back testing, and no clue how to derive probabilities from statistics on past data (very good point, it is indeed too complicated to explain in a blog post!)

- You are very bullish on TAC because you got advice from Sure Winner Top Notch Wall Street Analyst (SWTNWSA)

- You got a tip from that Famous Marabout Who Can Also Repair PC Hardware Failures Remotely (FMWCAPHFR)

- You are using Extra Sensory Perception To Forecast Market Movements (ESPTFMM), it usually fails miserably but this time it looks like perfect setup

- You Won’t Tell Me!

Do not worry, we are going to play a little game with little bit of money to spice it up. The rules are pretty simple:

- If your trade idea is profitable, I give you 10$

- If your trade idea is a looser, you give me any amount. Let your brain decide the amount! Since you are so bullish, and for this example, I assume you will play 500$

If you think I am too impressive to play against, imagine you are playing with Warren Buffet!

Now we are all set up for a probability calculation from your perspective! You need to solve the little equation system below:

Probability(Winning)/Probability(Loosing) = 500 / 10 = 50

Probability(Winning) + Probability(Loosing) = 1

Easy? So you (your brain) estimate the probability to win to be about 98%!

Let me be honest! Even with this huge asymmetrical setup, I will take the bet!

Why?

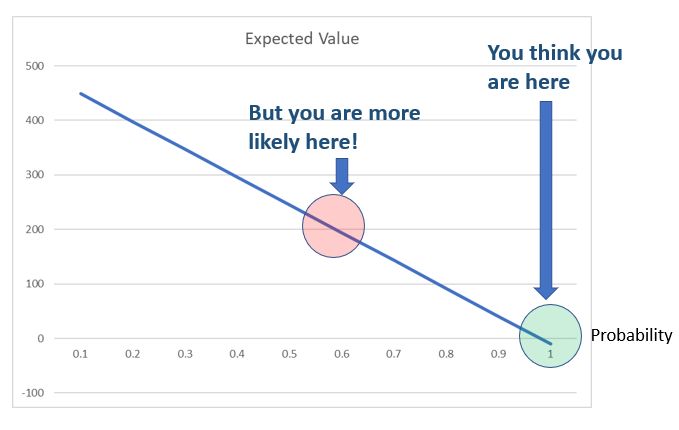

Let’s look at the expected value from my perspective, which takes into account what I know!

Best stock pickers score 85% winning trades and even with this value and this particular set up (500$ vs 10$), I have a positive expected value! I might not win this time, but if we play together a few times, I am almost sure to get those 500$ notes fly into my pocket!

Now think about it the other way around: if I have positive expected value, you have not! One way to overcome that is to significantly reduce the bet size, which in turn will also give you a better idea of the probability of success!

In summary, it is perfectly right to be bullish (in the sense of opinionated whatever market direction) and we need the bull force to enter trades. At the same time, you need to be skeptical about what your are being told and evaluate correctly the probabilities of winning, even with simple methodology as above!

And remember the following conclusions:

Sure winners ideas are sure to make you a looser over time!

Loosing risk consciousness makes you a sure winner over time!

That’s it! Until next time, trade safely!