Extract from Britannica:

Self-fulfilling prophecy, process through which an originally false expectation leads to its own confirmation. In a self-fulfilling prophecy an individual’s expectations about another person or entity eventually result in the other person or entity acting in ways that confirm the expectations.

A classic example of a self-fulfilling prophecy is the bank failures during the Great Depression. Even banks on strong financial footing sometimes were driven to insolvency by bank runs. Often, if a false rumor started that the bank was insolvent (incapable of covering its deposits), a panic ensued, and depositors wanted to withdraw their money all at once before the bank’s cash ran out. When the bank could not cover all the withdrawals, it actually did become insolvent. Thus, an originally false belief led to its own fulfillment.

We live in a world full of narratives, that we are asked to believe without asking questions. Most common ones are “Covid19 jabs work as expected” or “climate will be so hot by 2100, it will be a great disaster”. Those making those prophecies have no capability to justify their statement, so they have engaged in a deception process, which they can no longer escape, or at the price of their future if any. For jab, it is easy to manipulate data, hide facts about adverse reactions, … For climate, you won’t be there to verify since you will have died from the jab long before!

Those who disagree with the official prophecies are nicknamed conspiracy theorists, which is the ultimate insult to stop any debate about any topic. Now, we can look at these conspiracies theorists prophecies, right? All that they have predicted for the last 18 months is happening even faster than they would have imagined: vaccination failures, lockdowns, blaming non vaccinated, future climate lockdown, forever pandemic, …. Self-fullfilling? No! With the help of internet, these guys are very well informed, and read quite well through the plans, which makes politicians nervous and forced to accelerate in vain attempt to take back control.

Here is one of those idiot:

J. Trudeau is an imbecile! He has taken away freedoms from the people for a ridiculous virus, freedoms that they fought to get over the centuries, and now he will only give them back only if they take a poison pill!

Here is my prophecy for Trudeau and alikes, when jabbed people will wake up. There will be no mercy!

Climate warmists are no better, they try to spread fear and have started almost 20 years ago a narrative prophecy, whereby climate is changing fast due to human produced CO2. There is of course no proof of relationship between CO2 level and climate behavior. At time of dinausors, CO2 level was twelve times higher, the tree were gigantic size compared to today… but anyway, since people don’t ask questions, it is a good reason for future climatic lock down, where all data will be manipulated, there will be C02 passports, and who knows, maybe even CO2 vaccines!

Here is the key: ASK QUESTIONS! DON’T GIVE UP UNTIL YOU GET A FULLY JUSTIFIED ANSWER! No adverse reactions on vaccine? Show me the proof! You want report from hospitals! CO2 impacting temperature? Show me the corresponding studies, correlations over centuries, and show me data integrity!

Coming back to finance, Janet Yellen makes a prophecy of severe upcoming financial crisis if debt ceiling is not raised: rocketing intest rates, stock market crash. It is precisely BECAUSE of this debt ceiling raise THAT interests rate will eventually go up (hyper-inflation like) and that stock market will crash. Course n°1 or 2 in economics for dummies!

So again you should wonder and ASK QUESTIONS before the corrupted governments tries to dry your accounts because you are not jabbed, you have a car that is polluting too much CO2 and you have invested in stock markets, you little stupid!

Market Review

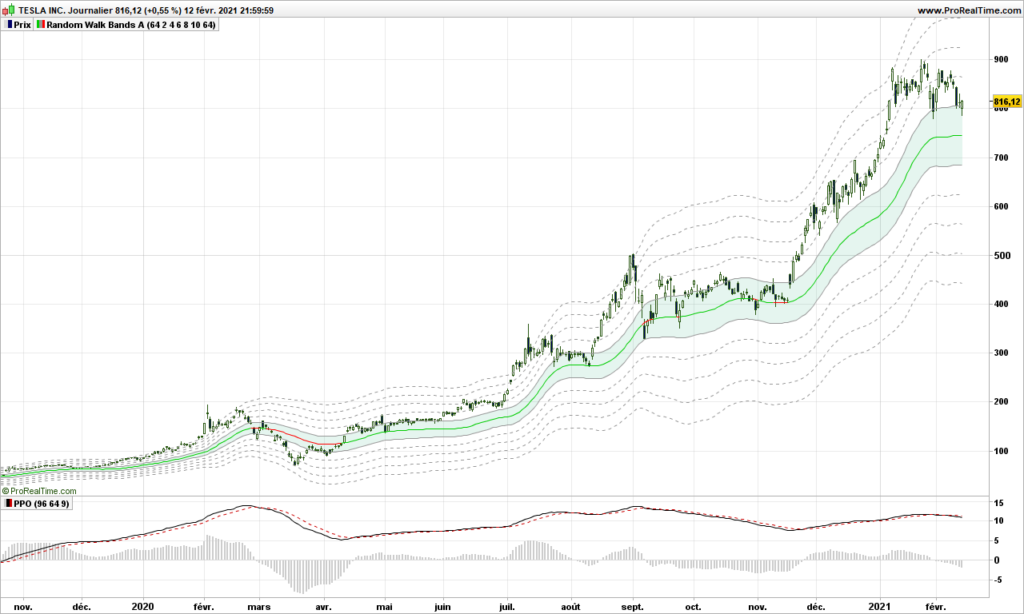

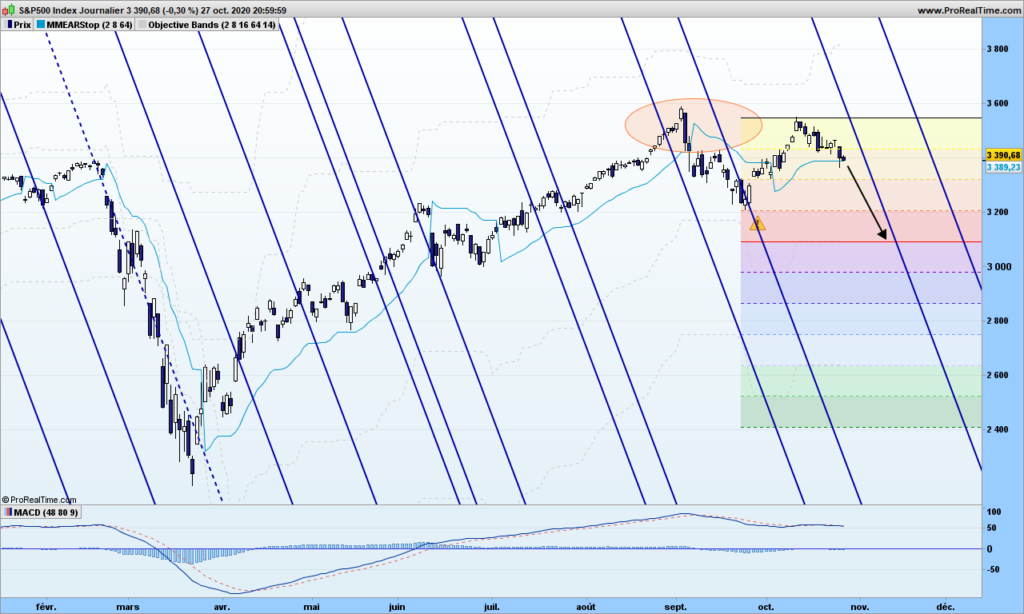

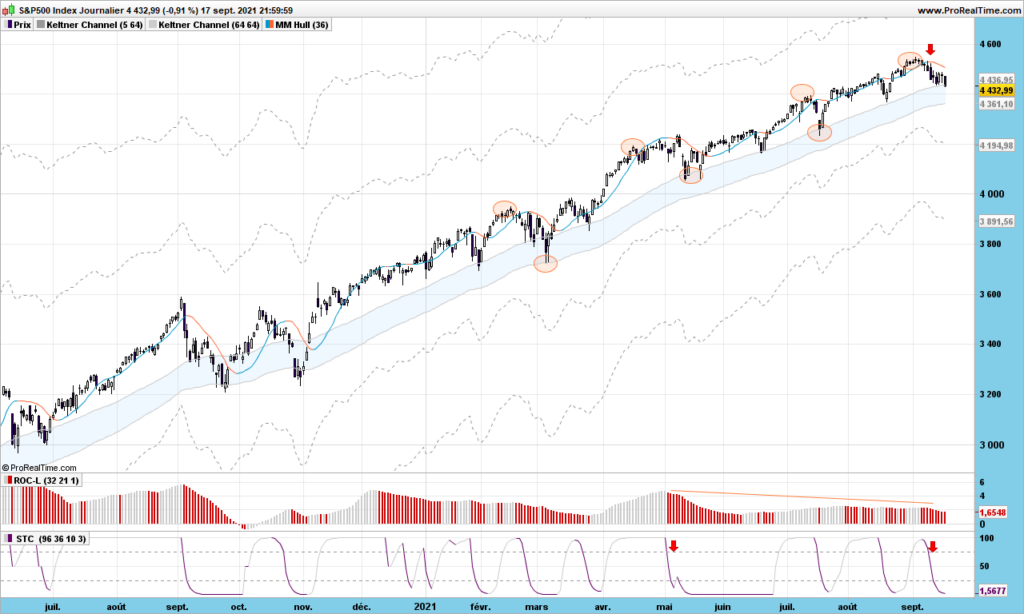

S&P is still in strong long term uptrend (above the blue river). There is a divergence (smoothed ROC second indicator) which points to possible trend change. Short term indicator at the bottom shows its third short signal in 3 months, which we can use for covering portfolio and more should market reverse).

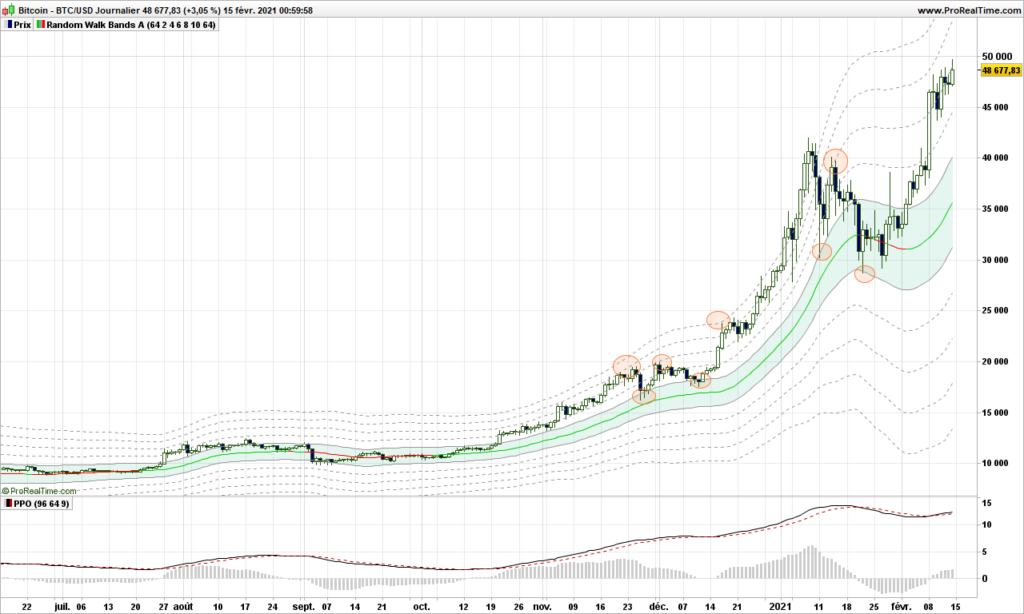

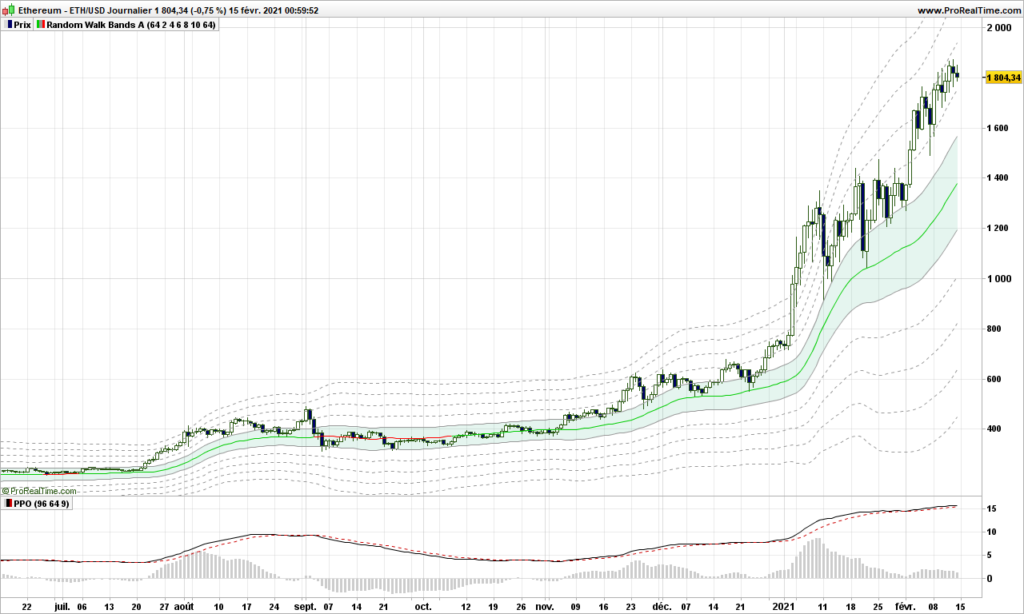

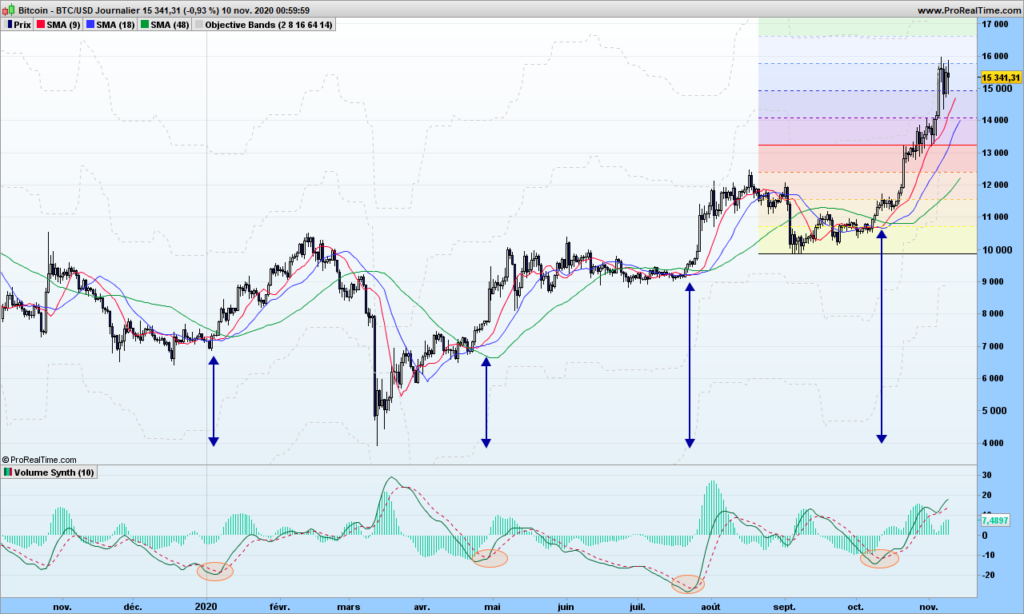

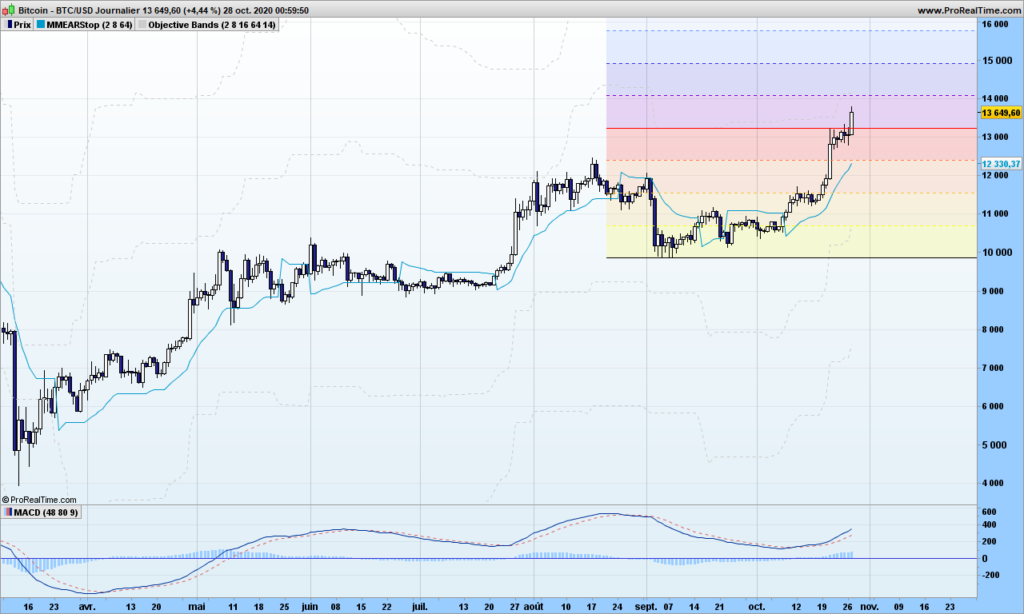

Bitcoin is still up as well but you can see that bottom the short signal. Since we can not short Bitcoin, I am waiting for this short signal to reverse, might be the start of next move towards 75k$. Reason being US$ value going down as debt ceiling is raised. Philosophical question: is debt a currency? :-))

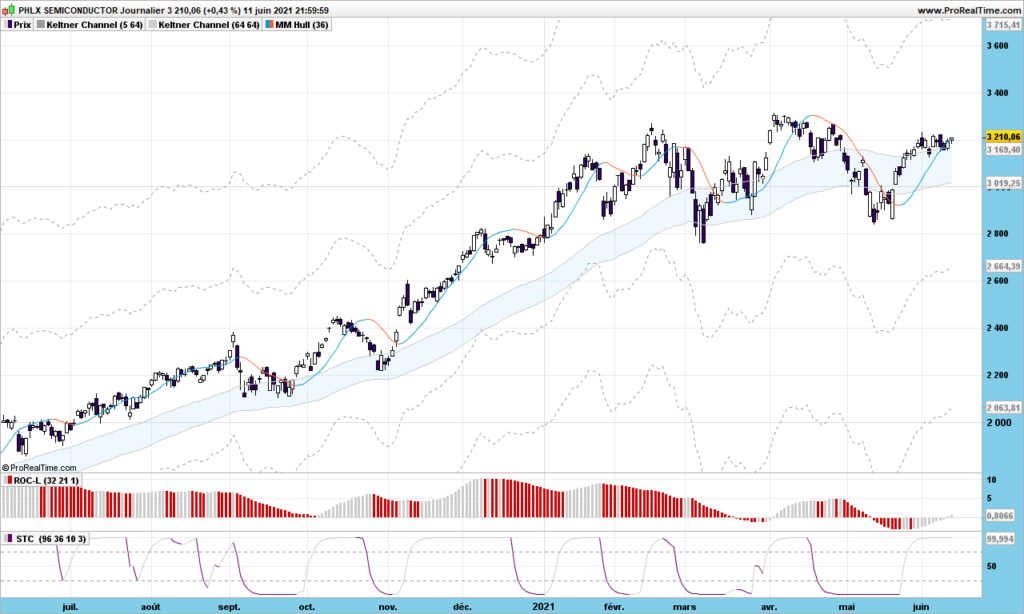

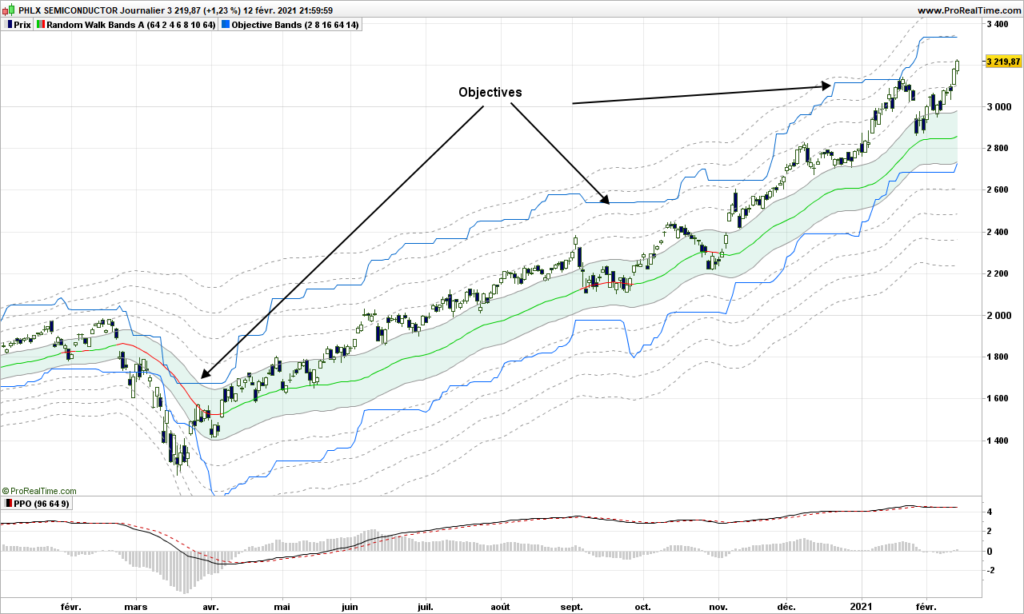

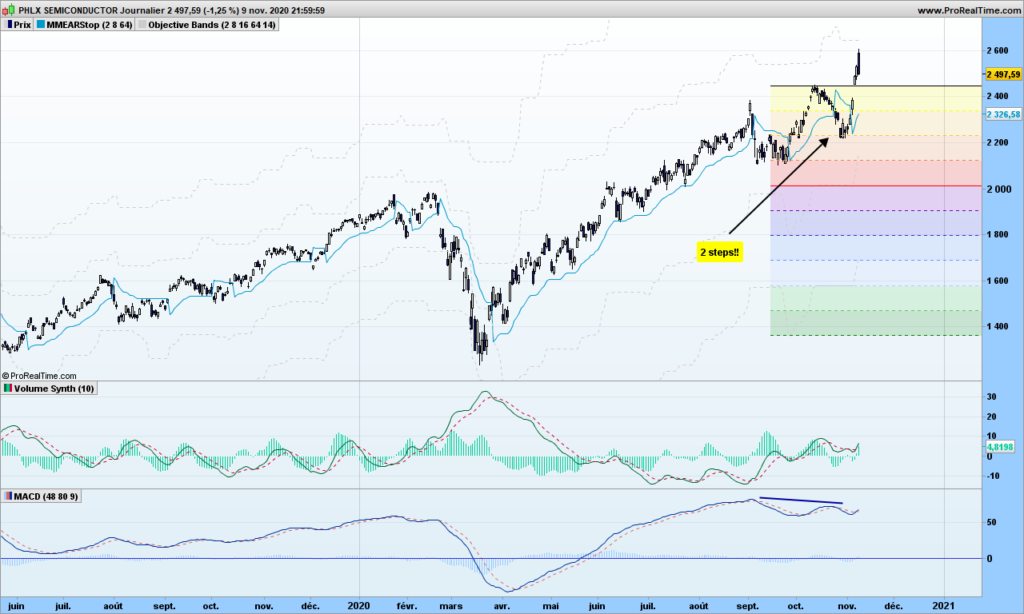

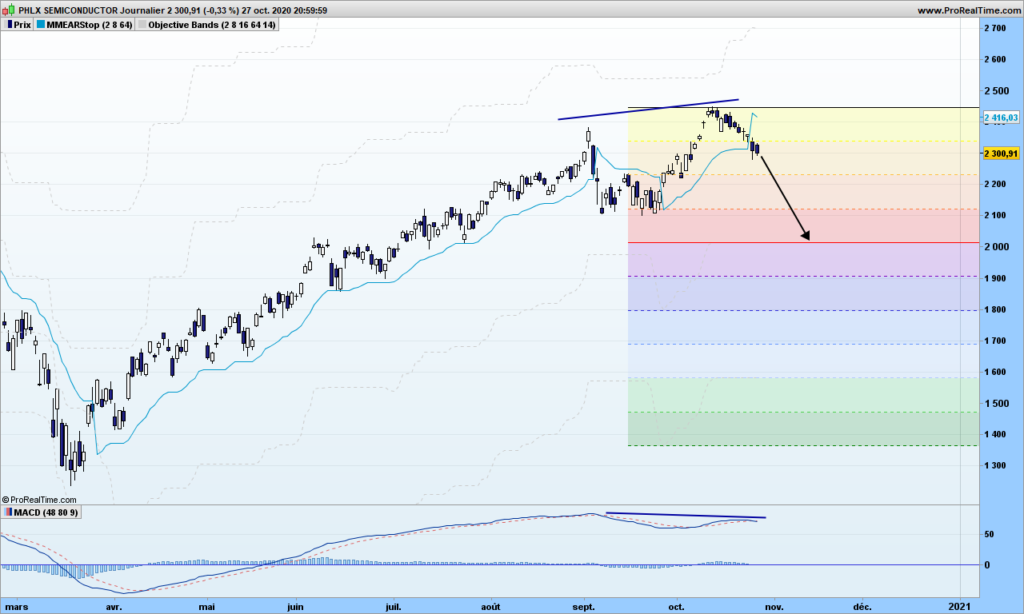

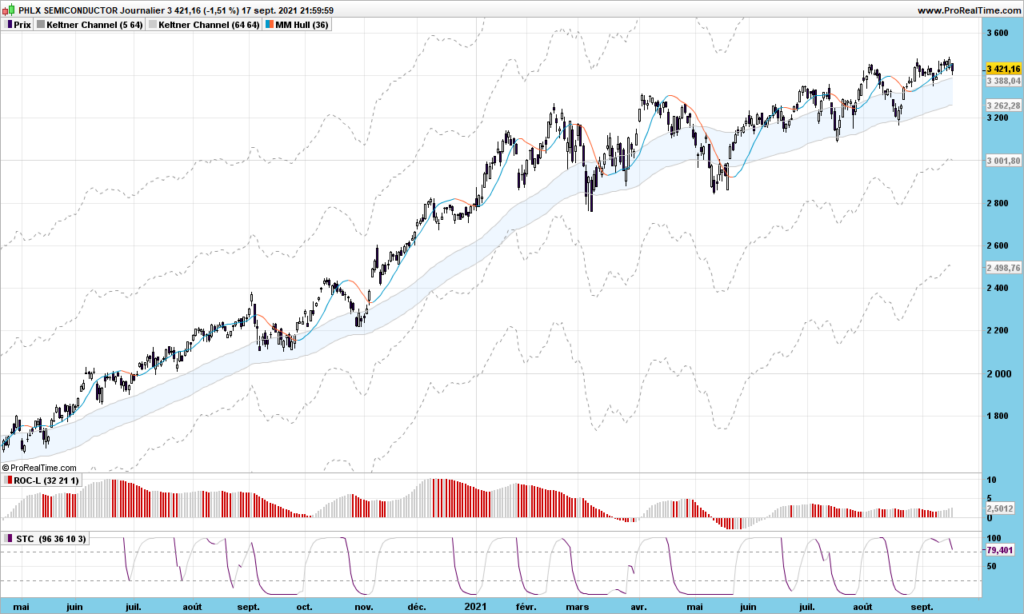

SOX (semi-conductor index) is important index to follow as it has some predicitive power. Semi-conductors are needed everywhere (for AI, 5G, …) so if sector is not looking good, expect some nasty wave on technology sector! What does it do? Slower than before but up! So my prediction is market crash is delayed! You can ask me questions, I will answer! :-))

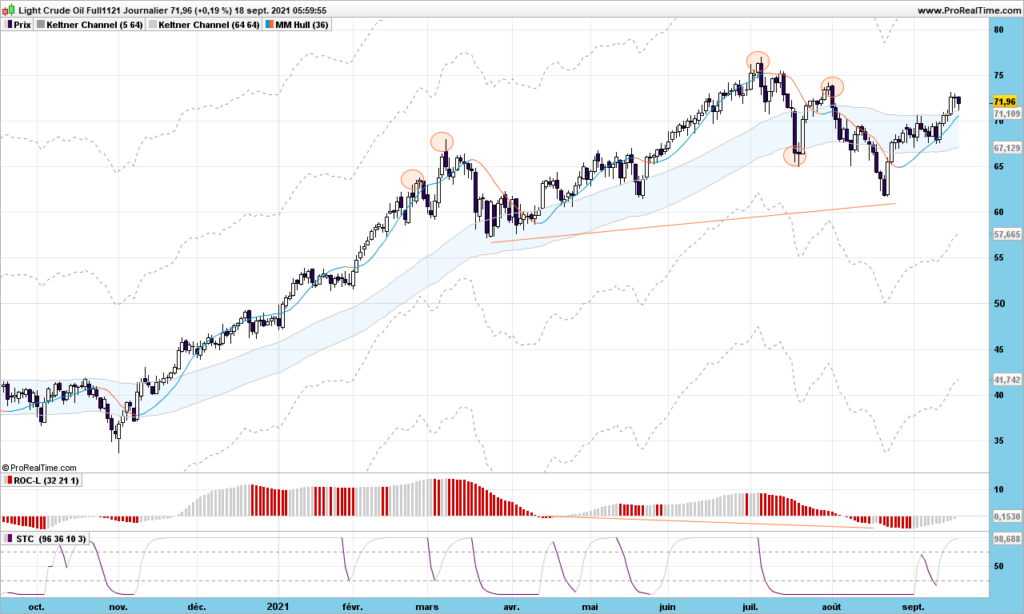

Oil is flashing a buy signal. Not good if you need to refill your car tank but having stocks like OXY and you get a refund via stock price increase and good dividends! Do not forget electric cars together with wind farms and solar panels will just not work (you will be able to recharge your battery once a month at best and at huge price). Oil price will go up, same as CO2 explained last week! Get ready for it!

That’s it for today.

I might loose my job in the future in line with ‘no jab no job’ policy in my country. I will surely have plenty of time to write by then. You can support if you wish with BCH address:

qquemq7cq6swh80c3rp99dq7vs8547r6t58vc7eq0r

That’s it for today. Until next time, trade safely!