This post will not be technical at all, only food for the mind!

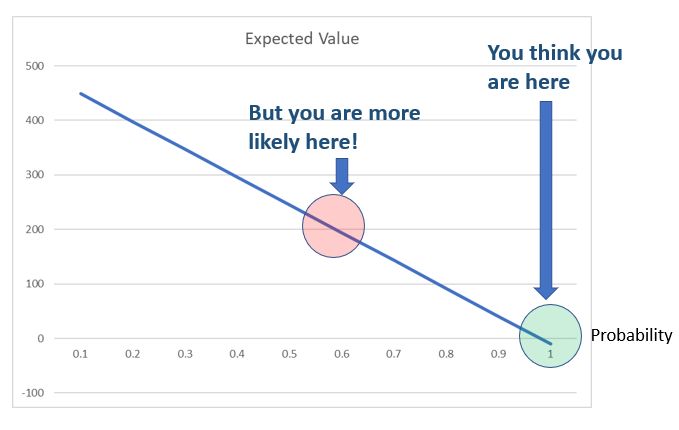

There are many brilliant brains throughout history and also many people who have had more luck than anyone else. Think of our dear Warren Buffet or even Bill Gates. If they had not been in the right place at the right time, they could have had totally different destinies! So was it luck or was it intelligence or both? Imagine one second that our computers could run OS/2 version 2020 operating system…

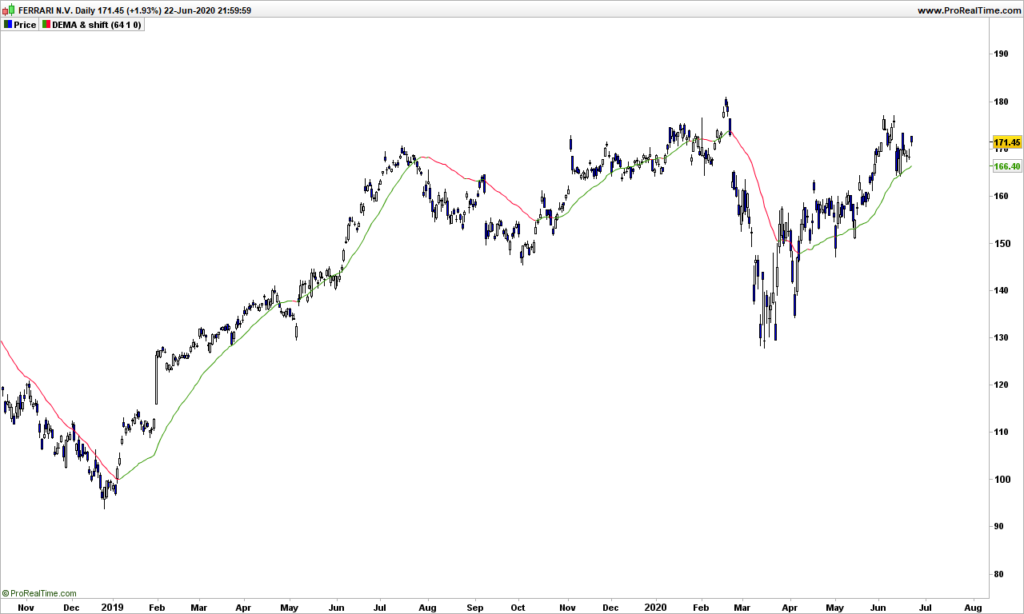

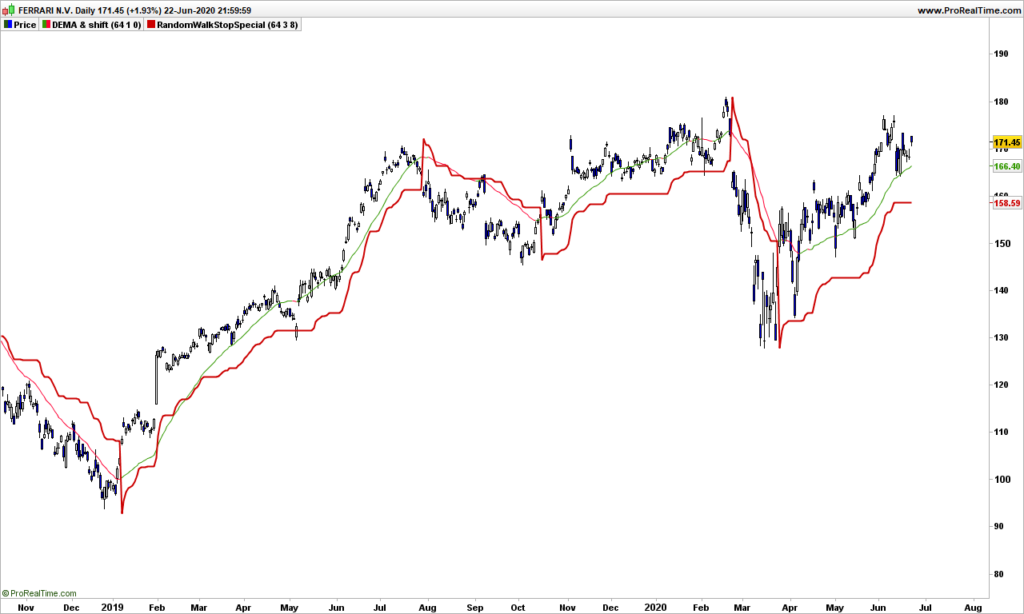

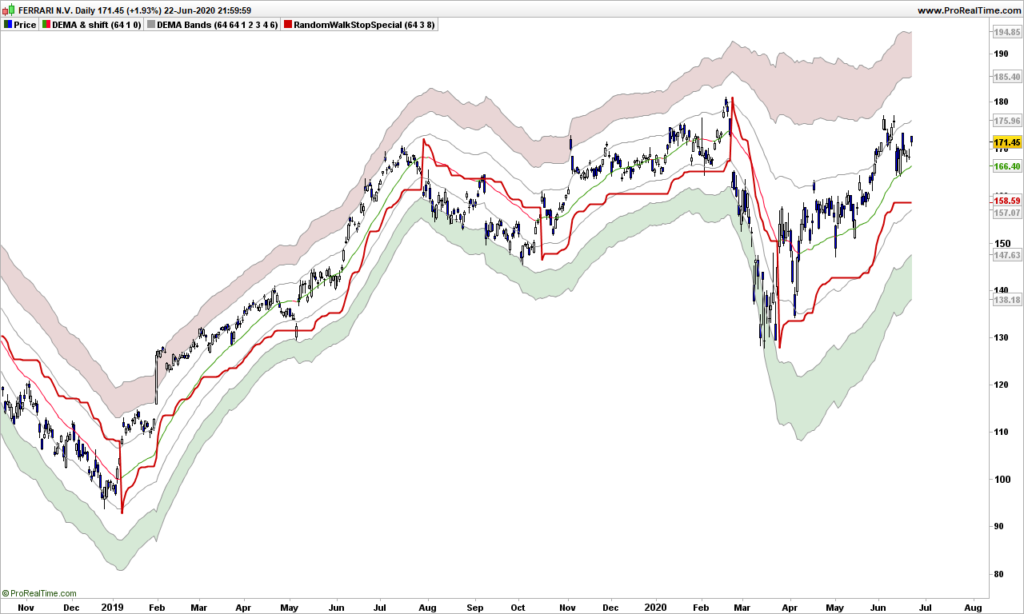

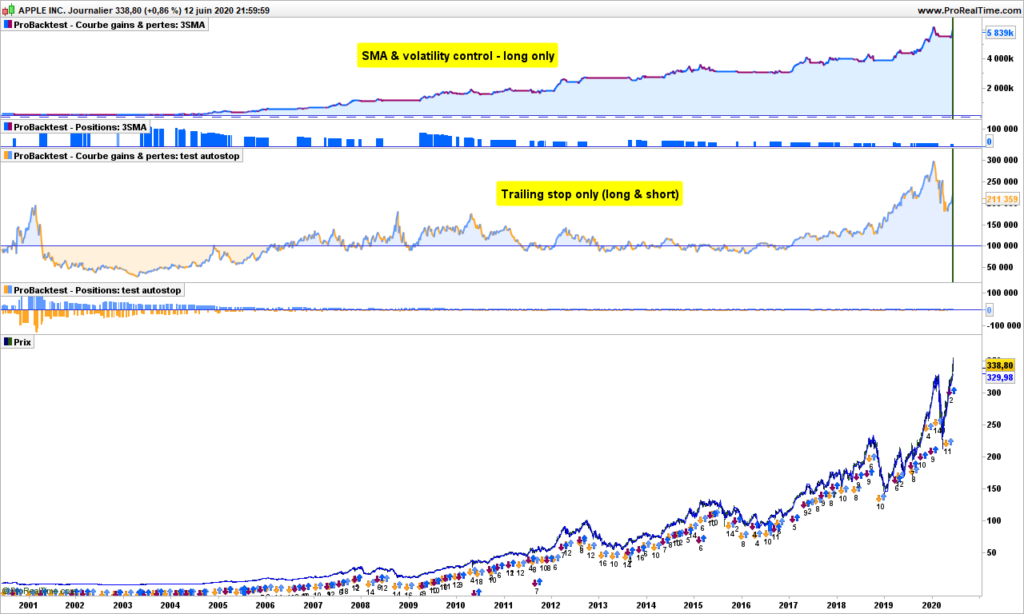

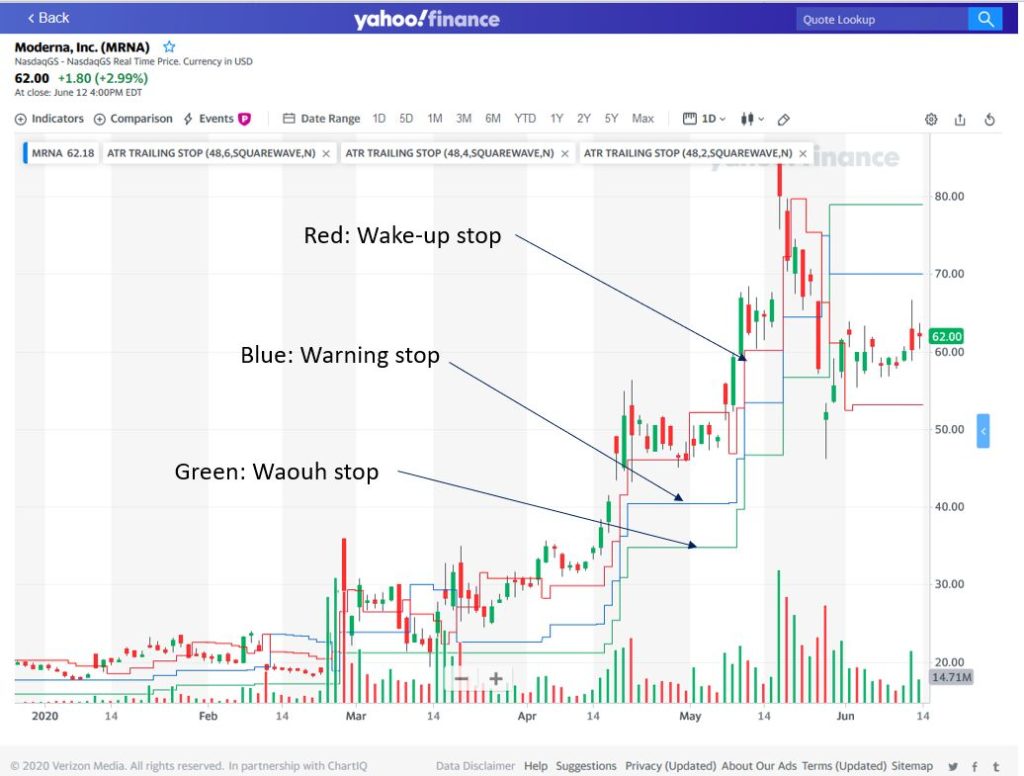

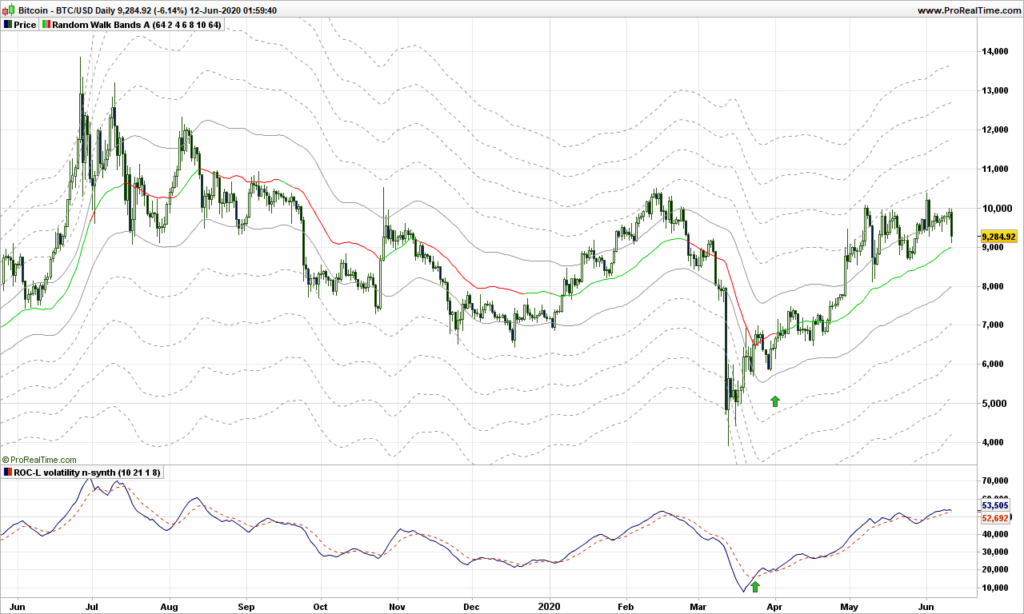

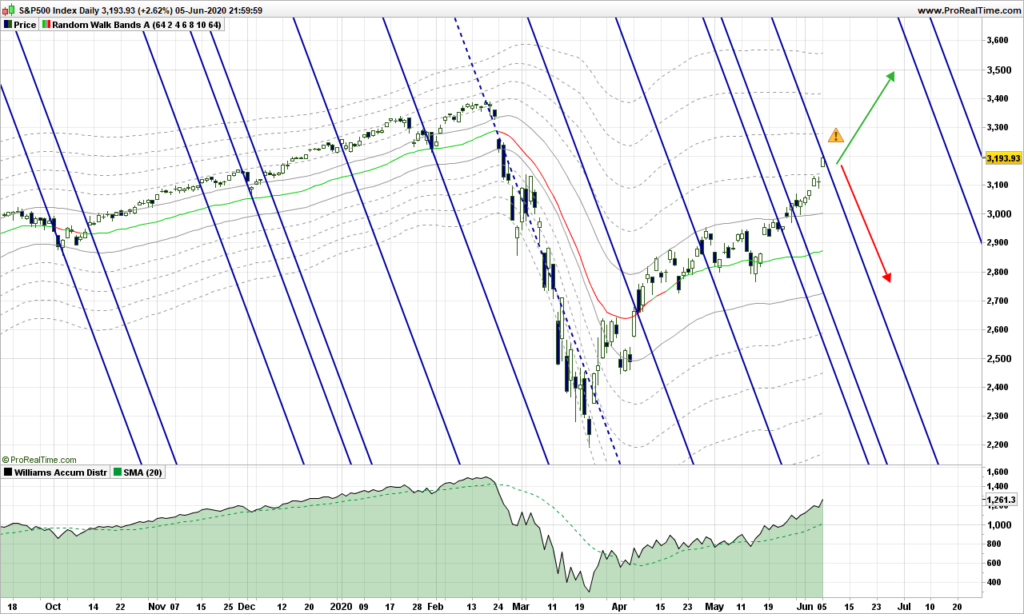

Finding an edge is key for trading, as your trading system needs to have a positive expectation if you want to be profitable over the long term. I have uncovered many edges in this blog that have been there for long, and will stay for long as it is unlikely that finance will change their model for a long time.

Now look at recent history: a small tiny virus has pushed many companies over the edge, pun intended! Finance is everywhere in each company, be it business case, cost tracking, profitability analysis, … and what? Companies are so weak, that a virus throws them off board?

The truth is more simple. The bosses are all trained in same business schools, applying same models without thinking about their validity. Role of chance is totally underestimated in their career, they think they manage successfully and will write books about it. Nothing is further from truth.

Finding a robust edge is key to your trading career. Most of those published on this blog can land you in positive territory but this is just the start. You need to work on your own edge, by finding new ones or improving those shared here. You do not need mathematics or philosophy to start with. Use these approaches only to confirm your theory. Honesty is also key: do not look for confirmations that your system is working, look at the cases where it does not work and find the reasons. Exactly what business schools are denying to do, because, should they do it, they would have to close their doors!

My latest trading strategy, which I can’t share of course, has found recently the mathematical confirmation I was looking for: Laplace first law of errors, created in 18th century! The second law of Laplace, also called Laplace-Gauss is the one used by finance in spite of its non applicability. The performance of the system is beyond all expectations… Laplace was a genius! Henri Poincaré is an other one of my favorites. Do you know them? H. Poincaré had identified the relativity before Einstein, who was only better at marketing it!