This post is for those of you that want longer term approach, many weeks at least, and don’t mind their portfolio swinging up and down with larges waves. Maybe it will make you appear very clever if you can decipher and explain the chart to someone unaware of this technique!

For an in-depth introduction, please refer to Steve Nison’s book:

You may also refer to these sites: stockcharts or Colibri Trader.

I do not agree to use ATR as reversal amount as your chart will change over time, and you will loose track of why you entered the market. Just use the 3% reversal, it will do a perfect job!

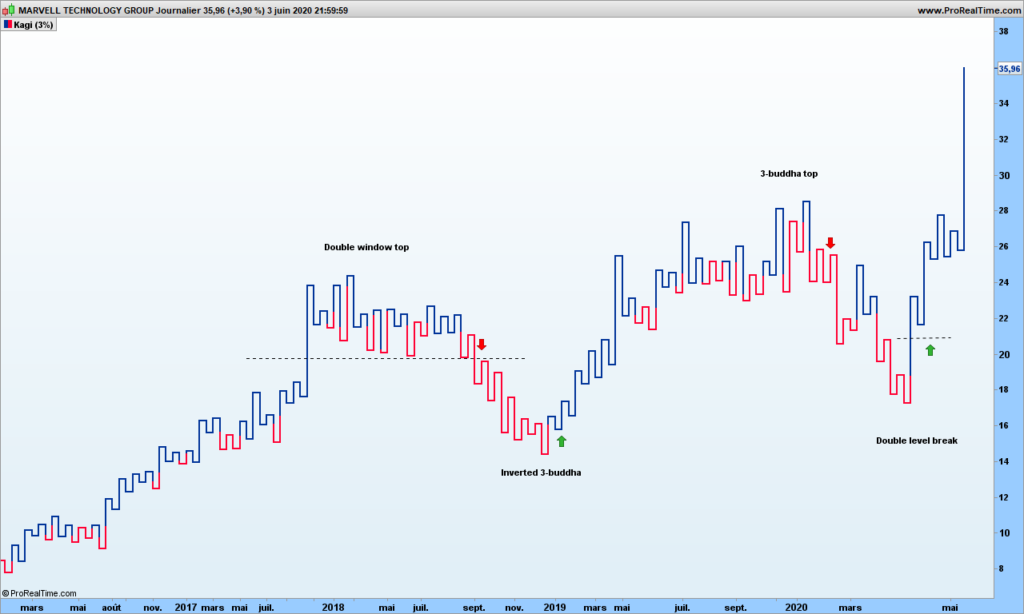

Again, I am assuming you already know about Kagi charts which look like this one for Marvell. See last green arrow shows a positive and undoubted profitable signal!

Kagi charts filter out the daily noise and we are left with raw trend. Remember that people may change opinion at any time, so the charts may look convoluted from time to time.

There are interesting traditional figures mentioned in Steve Nison’s book that do appear from time to time. It does not hurt to pinpoint those patterns!

The basic buy signals, when kagi line goes from red to blue, appear quite often but obviously there are many false signals! Pretty much like the TLB charts (previous post), we need some tools to filter them out.

For each vertical segment, between 2 u-turns, we consider high and low to be top and bottom of each segment, open is the low for up moving lines and close is the top (opposite for down moving lines). Easy, isn’t it?

Bollinger bands are again useful, fantastic! Even the good old MACD feels more comfortable with this kind of charts. Let’s look at Gilead chart:

MACD divergences warn you about upcoming changes. Bollinger bands are clearly closing on on prices during consolidation and breakouts are solid confirmations. We can use the %B indicator to tell us when the bands are moving away from each other. Here is Tesla chart:

As you can see, in May 2020, an inverted 3-buddha bottom appeared, was soon confirmed my MACD crossover. Then in October, the %B has crossed its signal line (a 5 candles exponential moving average). We are on board! On March 5th, we get a 3-buddha top, we are out with a cool 162% gain. We are not playing the down move from there since the overall trend is still up, and Bollinger bands are contracting. Beginning of April, we are again getting again a buy-signal (2-level break following inverted 3-buddha bottom confirmed by MACD), up to you to play it or not! Note how those Bollinger bands are quite flat from 2017 till end middle of 2019, they tell you not not to play any signal in any direction!

A word of caution must be mentioned here! Back to probabilities!

The probability of a trend change given the fact that you see a reversal patter (double window for instance) AND Bollinger bands expanding AND MACD greater than signal does ONLY mean potential reversal. We are improving the odds in our favor but I can not give you figures because backtesting on those charts in not possible. I tested manually over maybe two hundreds of charts, about 50% of trades should be profitable. The fact is you don’t know how far will the trend go. This is why, should you have time, it is good to revert back to old candlestick charts and draw the fabulous action-reaction lines to find out the potential!

That’s it! Those of you wanting material for week-end perusal, you get it!

Until next time, trade safely!

Note: if you wonder why I am using Bollinger bands here, it is because prices are filtered out of the daily noise. These are ‘trend’ graphics. The bands often prove to be decent prices objectives. This is of course to be taken lightly and cross-checked by more serious methodologies!

Like!! I blog quite often and I genuinely thank you for your information. The article has truly peaked my interest.