I have talked many times how the volume of information (fake or real) continuously unloaded onto media (social or not) is actually misleading (or trying to) your trading activity, just as using those brackets in the text! Trading the mathematical way just helps you with information overload.

You may have noticed I have not talked the actual volume data so far, one reason being that it is not freely available for all the supports we want to trade with. I am going to show you how to simulate this information, and how to more easily analyze volume information.

Let’s play with CGC – Canopy Growth Corp, a company involved in Cannabis business (just to attract search engines!). Volume is usually display in form of histogram at the bottom of your graph, with up days in green color and down days in red color.

There seems to be some outstanding spikes here and there, these are usually linked to specific events, could be quarterly results, and dividends payments, or law changes, or market important information. These can be some good entry points in a trend, especially if you missed the beginning.

Before we jump to more detailed analysis, if you consider Bitcoin or even some sector index, you may not get this information easily, or you may need to pay for it. So it would be good to simulate it, even if we would be missing the actual scale information, i.e. the real volume information.

I have already mentioned in WAD2.0 post that Williams Accumulation Distribution can be calculated without volume information

1. Calculate True High (TRH) and True Low (TRL)

TRH = Current bar high or precious bar close, whatever is higher

TRL = Current bar low or previous close, whatever is lower

2. Calculate current bar Accumulation/Distribution:

if Current close is above previous close then

AD = Current Close – TRL

if current close is below previous close

AD = Current close -TRH

if current close = previous close then

AD = 0

The absolute value of AD is the simulated volume. Let’s look at it:

You can see the spikes in volumes are located at the same place, more or less. So now we can use this calculation to get volumes sort of information for Bitcoin or Gold or whatever… Good, one problem fixed! On top of that, I can even make it smoother with synthetic bars as explained in same post mentioned above!

Now you would like to know if volume is really going up or down in more accurate way, maybe something you can even automate. As a reminder, this is linked to your observation period, you will to consider parameters that make sense to you. The solution is straightforward, let’s apply the good old MACD to volume.

Whaouh, we can see things now! Note I used the 10-days synthetic volume here to smooth things out and a MACD with 40-80-9 parameters. Volume does not tell you the trend but you know a trend is starting or getting stronger if volume is going up! On the right side, you see the recent rally is helped by strong volume increase, just get in the market and then use stop or objective or whatever strategy to get out. Volume will indeed go down when the trend cools down, and then volumes will go up again but it might trend continuation or trend reversal (see first arrow!)

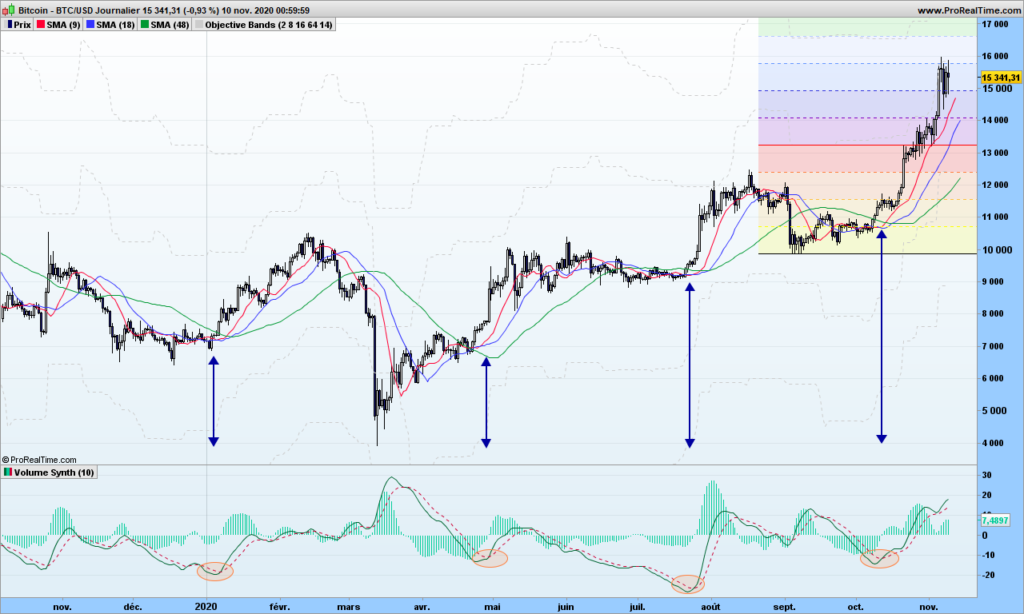

Now look at this Bitcoin chart:

See? Each rally is preceded by a signal cross over MACD. Confirmation by the moving averages. Easy, isn’t it?

That’s it! Until next time, trade safely!