I am sure you have noticed by now that this blog is totally original and I will not cover the basic indicators, their usage, … There are millions of sites that copy/paste from each other and you won’t learn from them anything but the basics. It is always a good idea to come back to basics, but profitable trading is about having an edge, so none of basic indicators work for very long, when too many traders are using one, market becomes sort of immune to it!

With this blog, I aim to help you kick some ideas down the road and if you wish you can share on this blog. Maybe it does not work for you as expected, but it may inspire others. Just drop me an email (see pinned message) and I will publish your article!

Let me share a story. For very long years, I made a few trades per year and had absolutely no idea how to get in or to get out. so I did some buy and hold based on randomly selected analysis, watching the stocks loose as much as 50% then going back up… And one morning I had an idea: imagine a very tall tree and there is a big coconut hanging from the top branches and a monkey happens to walk by and being thirsty. The easiest part of course is climbing, reaching the top, secure yourself to branches with feet and one hand while extending the other hand to take the fruit. Then suddenly, one branches cracks. You are still hanging from one branch with one hand but you are still safe, sort of! But for how long? The second branch is bending now and you must make a decision: free fall to the ground (not a good idea) or jump down other branches. This is how I started designing my first trailing stop! See? Let me know how you come up with trading strategies, fun to share and comment!

I still have plenty of ideas to share. I will not share publicly the details of my very best strategy because I am using it, but there is no problem sharing older research material that you can choose to improve on your side and share with the club! Just to give you an idea, we will look at in future posts:

- EMA, DEMA, and the collection of moving averages

- Accumulation / Distribution

- The wonders of smoothed ROC

- Kagi trading with volatility

- 3-line-breaks trading with volatility

- Others

So far I have demonstrated:

- Markets follow a random path which can be drawn.

- Markets can trend and this is due to their random nature. See here.

- The randomness can be measured by volatility. The raw volatility (be it 1-day momentum, True Range, …) is the one to be analyzed and understood

- You should not try to confirm stubbornly a strategy because cases where your strategy does not work surely exist and might even be the most profitable cases! Market’s got some sense of humor :-))

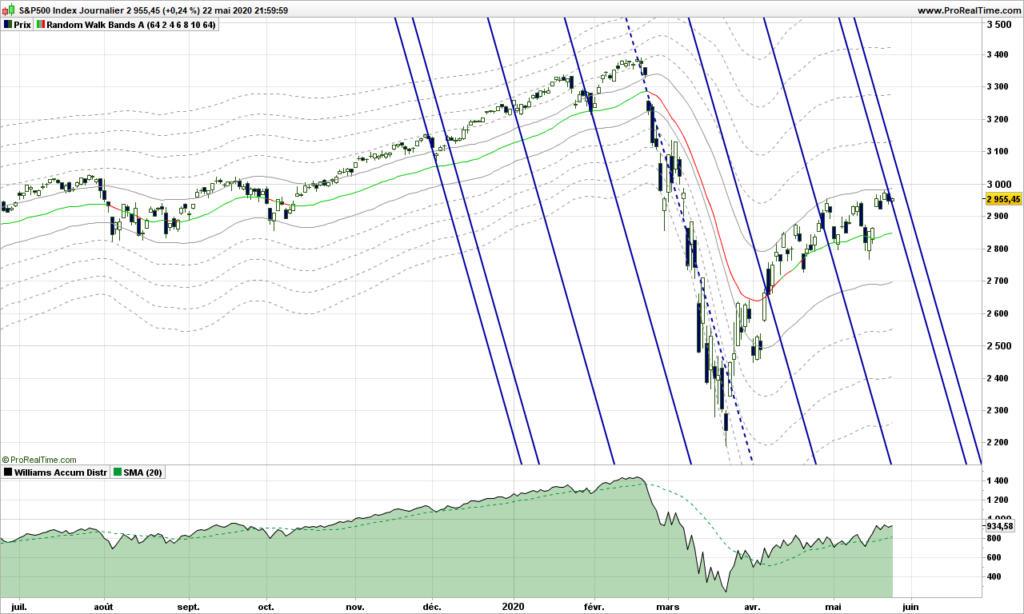

Now, as title implies, let’s look at S&P500 and where it is going!

As a continuation from previous post, I have left the random walk path and you can see that our drunken man does not seem capable to go more that 2 steps away from the main path.

If you have read my initial posts, you know I like a lot Action/Reaction lines because tops and bottoms are often building on those. Here we are precisely with 2 solid blue lines across the path. Unless S&500 goes through forcefully, we are in for a reversal. I have included Accumulation / Distribution at the bottom, which is a good indicator when you have nothing better, just add a 20-days simple moving average. There is not much energy: look at the slope of price versus indicator! We need some very good news to move up now! So yes, I would wait a few more days to see where we are going and go short if confirmed for an objective at 2400. This is absolutely no advice!!!

Until next time, trade safely!

Quality articles or reviews is the key to interest the people to pay a quick visit the site, that’s what this website is providing.|

After checking out a few of the blog posts on your web site, I honestly appreciate your way of writing a blog. I bookmarked it to my bookmark webpage list and will be checking back soon. Take a look at my web site as well and let me know how you feel.

I’m extremely pleased to find this website. I want to to thank you for ones time due to this fantastic read!! I definitely loved every bit of it and I have you saved as a favorite to look at new stuff on your website.

Way cool! Some very valid points! I appreciate you writing this write-up and also the rest of the website is extremely good.

You need to be a part of a contest for one of the best blogs on the net. I am going to highly recommend this web site!

May I simply just say what a relief to find somebody who genuinely understands what they are talking about online. You actually understand how to bring a problem to light and make it important. More and more people really need to look at this and understand this side of your story. It’s surprising you’re not more popular given that you certainly possess the gift.

I like it whenever people come together and share thoughts. Great blog, continue the good work!

Really appreciate you sharing this blog.Much thanks again. Much obliged.

Hi there! I simply want to offer you a huge thumbs up for the excellent information you have got here on this post. I will be returning to your site for more soon.

Wow, that’s a few things i was looking for, just what a data!

existing at this website, thanks admin with this website.

my webpage :: ShelliNDitta

bookmarked!!, I really like your web site!

Major thanks for the blog post.Thanks Again. Great.

Hey, thanks for the blog article.Really looking forward to read more. Really Great.

I am so grateful for your post.Really thank you! Want more.

This is one awesome blog post.Much thanks again. Will read on…

Thank you ever so for you post.Thanks Again. Great.

I truly appreciate this post.Much thanks again. Cool.

I truly appreciate this blog. Great.

Hey, thanks for the post. Want more.

A round of applause for your blog post.Thanks Again. Cool.

I am so grateful for your blog article.Really looking forward to read more. Will read on…

Muchos Gracias for your blog. Fantastic.

A big thank you for your blog.Thanks Again. Want more.

I cannot thank you enough for the blog post.Much thanks again. Cool.

Thanks for the blog article.

I cannot thank you enough for the blog. Much obliged.

Thank you for your blog article.Really thank you! Cool.

Awesome article post.Really thank you! Really Cool.

A big thank you for your blog post.Thanks Again. Great.

Im thankful for the post. Want more.

Fantastic article.Really thank you! Will read on…

I really like and appreciate your post.Really thank you! Great.

I truly appreciate this article.Thanks Again. Keep writing.

Really enjoyed this blog.Really looking forward to read more. Fantastic.

Major thankies for the blog post. Really Great.

Im thankful for the article post.Really looking forward to read more. Really Cool.

Say, you got a nice blog.Really looking forward to read more. Fantastic.

Enjoyed every bit of your article.Really thank you! Awesome.

Like!! Really appreciate you sharing this blog post.Really thank you! Keep writing.

Like!! Thank you for publishing this awesome article.